eBay 2000 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2000 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.eBay Inc.

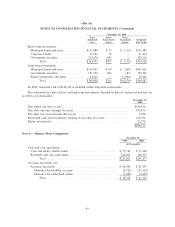

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

in the event the net book value of such assets exceeds the future undiscounted cash Öows attributable to such

assets.

Intangible assets

Intangible assets resulting from the acquisitions of entities accounted for using the purchase method of

accounting are estimated by management based on the fair value of assets received. These include acquired

customer lists, workforce, technological know how, covenants not to compete and goodwill. During the year

ended December 31, 2000, a subsidiary of eBay purchased the technology and related workforce from the

Precision Buying Service, a division of Deja.com, in which eBay recorded an intangible asset of approximately

$5.9 million. Intangible assets are amortized from eight months to ten years on a straight-line basis which

represents the estimated periods of beneÑt.

Environmental expenditures

eBay owns or controls real estate properties that are either used in the auction business or leased to

unrelated parties for various commercial applications. Certain environmental and structural deÑciencies have

been identiÑed in the past for which eBay has remediation responsibility. The amounts accrued to correct

these matters are based upon estimates developed in preliminary studies by external consultants. Due to

uncertainties inherent in the estimation process, the amounts accrued for these matters may be revised in

future periods as additional information is obtained.

Environmental expenditures that relate to an existing condition caused by past operations, and that do not

contribute to current or future revenue generation, are charged to expense. Liabilities are recorded when

environmental assessments are made, remediation obligations are probable and the costs can be reasonably

estimated. The timing of these accruals is generally upon the completion of feasibility studies. As of

December 31, 1999 and 2000, estimated liabilities of approximately $5.8 million are included within other

liabilities.

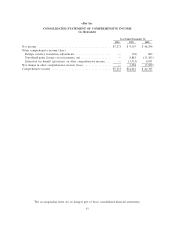

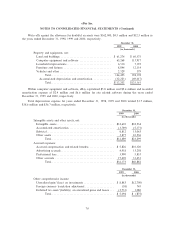

Comprehensive income

eBay accounts for comprehensive income in accordance with SFAS No. 130, ""Reporting Comprehensive

Income.'' SFAS No. 130 establishes standards for reporting comprehensive income and its components in

Ñnancial statements. Comprehensive income, as deÑned, includes all changes in equity (net assets) during a

period from non-owner sources. The change in comprehensive income for all periods presented resulted from

foreign currency translation gains and losses and unrealized gains and losses on securities.

Revenue recognition

Online transaction revenues are derived primarily from placement fees charged for the listing of items on

the eBay website, success fees calculated as a percentage of the Ñnal sales transaction value for both eBay and

Half.com, and to a lesser extent, online advertising.

Listing and featured item fee revenue is recognized ratably over the estimated period of the auction while

revenues related to success fees are recognized at the time that the transaction is successfully concluded. A

transaction is considered successfully concluded when at least one buyer has bid above the seller's speciÑed

minimum price or reserve price, whichever is higher, at the end of the transaction term. Advertising revenues,

which are principally derived from the sale of banners or sponsorship on the eBay site, are recognized as the

impressions are delivered, or ratably over the term of the agreement where such agreements provide for

minimum monthly or quarterly advertising commitments or such commitments are Ñxed throughout the term.

Provisions for doubtful accounts and authorized credits to sellers are made at the time of revenue recognition

based upon our historical experience.

61