eBay 2000 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2000 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

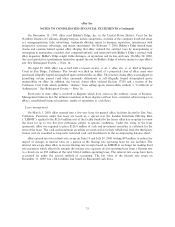

On December 10, 1999, eBay sued Bidder's Edge, Inc. in the United States District Court for the

Northern District of California alleging trespass, unfair competition, violation of the computer fraud and abuse

act, misappropriation, false advertising, trademark dilution, injury to business reputation, interference with

prospective economic advantage, and unjust enrichment. On February 7, 2000, Bidder's Edge denied these

claims and counterclaimed against eBay alleging that eBay violated the antitrust laws by monopolizing or

attempting to monopolize a market, that competed unfairly, and interfered with Bidder's Edge's contract with

eBay magazine. Bidder's Edge sought treble damages, an injunction and its fees and costs. On May 24, 2000,

the court granted us a preliminary injunction against the use by Bidder's Edge of robotic means to copy eBay's

site. See Subsequent Events Ì Note 16.

On April 25, 2000, eBay was served with a lawsuit, Gentry et. al. v. eBay, Inc. et. al, Ñled in Superior

Court in San Diego, California. The lawsuit was Ñled on behalf of a purported class of eBay users who

purchased allegedly forged autographed sports memorabilia on eBay. The lawsuit claims eBay was negligent in

permitting certain named (and other unnamed) defendants to sell allegedly forged autographed sports

memorabilia on eBay. In addition, the lawsuit claims eBay violated Section 17200 and a section of the

California Civil Code which prohibits ""dealers'' from selling sports memorabilia without a ""CertiÑcate of

Authenticity.'' See Subsequent Events Ì Note 16.

From time to time, eBay is involved in disputes which have arisen in the ordinary course of business.

Management believes that the ultimate resolution of these disputes will not have a material adverse impact on

eBay's consolidated Ñnancial positions, results of operations or cash Öows.

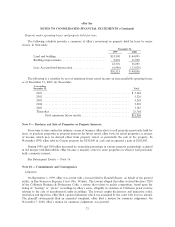

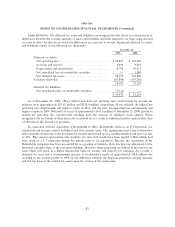

Lease arrangement

On March 1, 2000, eBay entered into a Ñve-year lease for general oÇce facilities located in San Jose,

California. Payments under this lease are based on a spread over the London Interbank OÅering Rate

(""LIBOR'') applied to the $126.4 million cost of the facility funded by the lessor. eBay has an option to renew

the lease for up to two Ñve-year extensions subject to speciÑc conditions. Under the terms of the lease

agreement, eBay was required to place $126.4 million of cash and investment securities as collateral for the

term of the lease. The cash and investment securities are restricted as to their withdrawal from the third party

trustee and are classiÑed as long-term restricted cash and investments in the accompanying balance sheet.

eBay entered into two interest rate swaps on June 19 and July 20, 2000 totaling $95 million to reduce the

impact of changes in interest rates on a portion of the Öoating rate operating lease for our facilities. The

interest rate swaps allow eBay to receive Öoating rate receipts based on LIBOR in exchange for making Ñxed

rate payments which eÅectively amends the interest rate exposure on our operating lease from a Öoating rate

to a Ñxed rate on $95 million of the total $126.4 million operating lease. The interest rate swaps have been

accounted for under the accrual method of accounting. The fair value of the interest rate swaps on

December 31, 2000 was a $4.4 million loss based on discounted cash Öows.

73