eBay 1999 Annual Report Download - page 73

Download and view the complete annual report

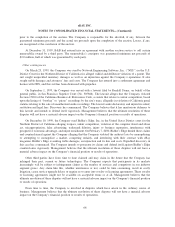

Please find page 73 of the 1999 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.On September 24, 1998, the Company completed its initial public offering of Common Stock. At that time,

all issued and outstanding shares of the Company’s Series A and Series B Convertible Preferred Stock were

converted into an aggregate of 27,827,019 shares of Common Stock.

Warrants for Series B Mandatorily Redeemable Convertible Preferred Stock

In connection with the issuance of Series B, the Company issued warrants to purchase 400,000 additional

shares of Series B with an exercise price of $5.00 per share. In May 1998, these warrants were exercised,

resulting in the issuance of 400,000 shares of Series B in exchange for cash proceeds totaling $2.0 million.

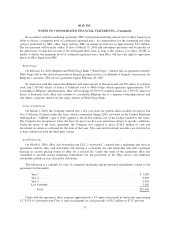

Note 13—Common Stock:

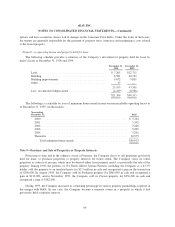

The Company’s Certificate of Incorporation, as amended, authorizes the Company to issue 900,000,000

shares of Common Stock. A portion of the shares outstanding are subject to repurchase by the Company over a

four-year period from the earlier of the issuance date or employee hire date, as applicable. At December 31,

1998 and 1999, there were 32,213,000 and 12,678,000 shares, respectively, subject to repurchase rights at an

average price of $0.04 and $0.12, respectively, per share.

In June 1998, in connection with the appointment of two outside directors, the Company sold an aggregate

of 643,500 shares of Common Stock to two directors and realized net proceeds of $2.0 million. The Company

recognized the $429,000 excess of the estimated fair value of the stock over the price paid by the two directors

as general and administrative expense in 1998.

At December 31, 1999, the Company had reserved 24,443,360 and 722,051 shares of Common Stock for

future issuance for the exercise of options under the stock option plans and issuance of shares under the employee

stock purchase plan, respectively.

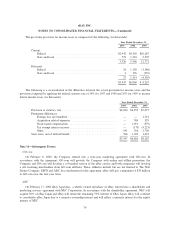

Note 14—Employee Benefit Plans:

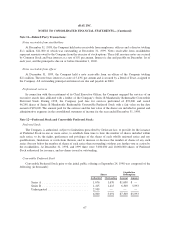

401(k) Savings Plan

The Company has a savings plan that qualifies as a deferred salary arrangement under Section 401(k) of the

Internal Revenue Code (the ‘‘401(k) Plan’’). Under the 401(k) Plan, participating employees may defer a

percentage (not to exceed 25%) of their eligible pretax earnings up to the Internal Revenue Service’s annual

contribution limit. All employees on the United States payroll of the Company age 21 years or older are eligible

to participate in the 401(k) Plan. The Company had not been required to contribute to the 401(k) Plan but in

1998 elected to match contributions up to a maximum of $1,500 per employee, and committed to matching

contributions to a maximum of $1,500 per employee per year in future periods. As a result, the Company

contributed and expensed $97,000 and $856,000 in the years ended December 31, 1998 and 1999, respectively.

As a result of the mergers with the Company in 1999, both B&B and Kruse terminated any existing defined

savings contribution plans and adopted the Company’s 401(k) Plan.

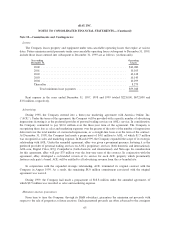

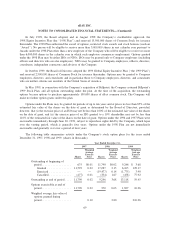

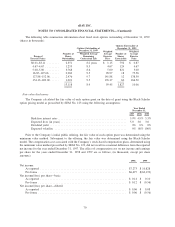

Stock option plans

In December 1996, the Company’s Board of Directors adopted the 1996 Stock Option Plan (the

‘‘1996 Plan’’), and in June 1997, adopted the 1997 Stock Option Plan (the ‘‘1997 Plan’’) (collectively, the

‘‘Plans’’). The Plans provide for the granting of stock options to employees and consultants of the Company.

Options granted under the Plans may be either incentive stock options (‘‘ISOs’’) or nonqualified stock options

(‘‘NSOs’’). ISOs may be granted only to the Company’s employees (including officers and directors who are

also employees). NSOs may be granted to the Company’s employees and consultants.

eBAY INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

68