eBay 1999 Annual Report Download - page 29

Download and view the complete annual report

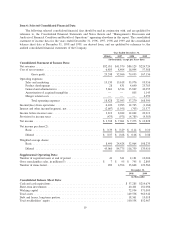

Please find page 29 of the 1999 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.and facilities costs. The Company’s general and administrative expenses increased in absolute dollars from

$6.5 million or 15.8% of net revenues in 1997 to $15.8 million or 18.4% of net revenues in 1998, and further

increased to $43.1 million or 19.2% of net revenues in 1999. During the periods from 1997 to 1998, and from

1998 to 1999, increases in general and administrative expenses were primarily driven by the online business.

The increase in expenses from 1997 to 1998 primarily resulted from several stock related transactions occurring

in 1998. These include the Company’s contribution in June 1998 of 321,750 shares of common stock with an

estimated fair value of $1.2 million to a charitable foundation, compensation expense of $429,000 associated

with the purchase of restricted shares of common stock by the Company’s outside directors and compensation

expense of approximately $1.7 million associated with stock options granted to employees. Additional year over

year increases resulted from increases in personnel related expenses, the allowance for doubtful accounts, fees

for professional services and overhead costs. Increases from 1998 to 1999 resulted primarily from additional

personnel-related expenses, including those associated with the SafeHarbora¨ program, fees for professional

services, public company expenses including various SEC filing fees and allocations of overhead. The Company

expects that general and administrative expenses will increase in absolute dollars and decrease as a percentage

of net revenues in future periods as eBay’s online business becomes a progressively larger piece of the

consolidated business. Such expenses in the online business are typically lower as a percentage of net revenues

than those in the traditional auction business.

Amortization of Acquired Intangibles

During 1998, eBay recognized expenses totaling $805,000 related to the acquisition of Jump Inc. (‘‘Jump’’).

The majority of the Jump acquired intangibles were fully amortized during 1999, with the remaining amortization

continuing through the third quarter of 2000. Other acquisition related intangibles will be amortized at varying

rates through 2009. From time to time the Company has purchased, and expects to continue purchasing, assets

or businesses in order to maintain its leadership role in online personal trading. These purchases may result in

the creation of intangible assets and lead to a corresponding increase in the amortization of acquired intangibles.

Merger Related Costs

During the year ended December 31, 1999, the Company incurred direct merger related transaction costs of

$4.4 million which were charged to operations. There were no comparable expenses in the same periods of 1997

or 1998. As opportunities present themselves, the Company may continue to acquire new companies; such

acquisitions could lead to additional direct and indirect expenses which would negatively affect the Company’s

results of operations.

Interest and Other Income (Expense), Net

The Company’s interest and other income (expense), net, consists of interest earned on cash, cash

equivalents, and short term investments offset by interest expense, minority interests in consolidated companies,

and income or loss in partnership equity. Interest expense is primarily derived from interest payments on building

mortgages held by B&B. The Company’s interest and other income (expense), net declined from $(2.0) million

or (4.8)% of net revenues in 1997 to $(703,000) or (0.8)% of net revenues in 1998 and became a gain of

$21.4 million or 9.5% in 1999. From 1997 to 1998, eBay’s online business was the primary contributor to interest

income from interest earned on the net proceeds from the Company’s initial public offering in September 1998

and, to a lesser extent, interest earned on proceeds from the exercise of warrants in May 1998. Those gains were

offset primarily by interest expense incurred on mortgages held by B&B. The gain in 1999 was primarily the

result of interest earned on cash, cash equivalents and investments, particularly the interest earned on the net

proceeds of the Company’s follow-on offering completed in April 1999. Interest expense was approximately

comparable between 1997, 1998, and 1999. The Company expects interest and other income (expense), net to

remain positive in 2000 due to the continued interest earned on the proceeds from the follow-on offering.

24