eBay 1999 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 1999 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

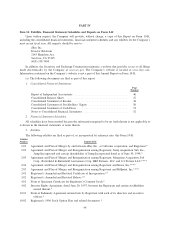

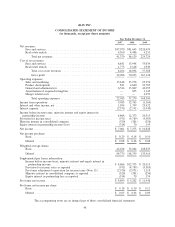

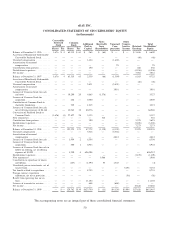

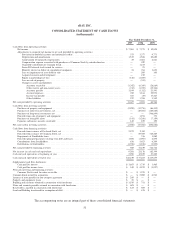

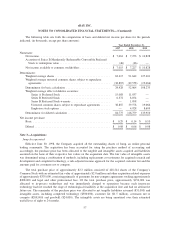

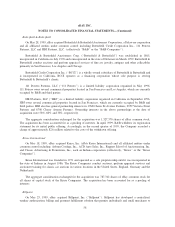

eBAY INC.

CONSOLIDATED STATEMENT OF CASH FLOWS

(in thousands)

Year Ended December 31,

1997 1998 1999

Cash flows from operating activities:

Net income ........................................................................... $ 7,061 $ 7,273 $ 10,828

Adjustments to reconcile net income to net cash provided by operating activities:

Provision for doubtful accounts and authorized credits ........................................ 373 3,377 4,771

Depreciation and amortization .......................................................... 1,519 4,526 20,650

Amortization of unearned compensation .................................................. 25 2,661 4,681

Compensation expense associated with purchases of Common Stock by outside directors .............. — 429 —

Charitable contribution of Common Stock ................................................. — 1,215 —

Series B Preferred stock issued for services ................................................ — 93 —

Minority interest in deficit of consolidated companies......................................... 24 764 1,651

Loss on impairment of asset held for sale ................................................. — 200 100

Acquired research and development ...................................................... — 150 —

Equity in partnership net loss .......................................................... (146) (4,025) —

Loss on sale of property .............................................................. — (333) —

Changes in assets and liabilities:

Accounts receivable .............................................................. (1,302) (8,369) (28,884)

Other current and non-current assets .................................................. (742) (3,702) (15,336)

Accounts payable ............................................................... 3,104 (3,112) 21,541

Accrued expenses ............................................................... 769 3,164 25,973

Income tax payable .............................................................. 363 (35) 17,247

Other liabilities ................................................................. 579 1,765 3,342

Net cash provided by operating activities ......................................................... 11,627 6,041 66,564

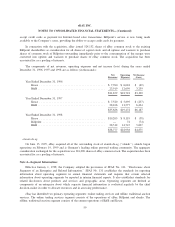

Cash flows from investing activities:

Purchases of property and equipment ........................................................ (2,990) (12,758) (86,432)

Purchases of short-term investments, net ...................................................... — (40,401) (140,685)

Purchases of long-term investments, net ...................................................... — — (368,894)

Proceeds from sale of property and equipment.................................................. — 1,274 173

Purchases of intangible assets .............................................................. (141) (1,248) (7,159)

Payments (advances) on notes receivable ..................................................... 145 109 109

Net cash used in investing activities ............................................................. (2,986) (53,024) (602,888)

Cash flows from financing activities:

Proceeds from issuance of Preferred Stock, net ................................................. 2,972 2,110 —

Proceeds from issuance of Common Stock, net ................................................. — 69,305 710,449

Repayments of Stockholder loans ........................................................... — 316 1,062

Proceeds (principal payments) on long-term debt and leases ........................................ 1,506 (1,967) 4,895

Contributions from Stockholders ............................................................ 638 5,623 6,204

Distributions to Stockholders .............................................................. (4,556) (3,228) (3,892)

Net cash provided by financing activities ......................................................... 560 72,159 718,718

Net increase in cash and cash equivalents ......................................................... 9,201 25,176 182,394

Cash and cash equivalents at beginning of year .................................................... 2,908 12,109 37,285

Cash and cash equivalents at end of year ......................................................... $12,109 $ 37,285 $ 219,679

Supplemental cash flow disclosures:

Cash paid for interest .................................................................... $ 1,893 $ 1,710 $ 1,465

Cash paid for income taxes ................................................................ $ 540 $ 4,932 $ (1,927)

Non-cash investing and financing activities:

Common Stock issued for notes receivable .................................................... $ — $ 1,378 $ —

Common Stock issued for acquisition ............................................................ $ — $ 2,000 $ 6,943

Issuance of note payable for non-compete agreement ................................................ $ 240 $ — $ —

Property and equipment leases ................................................................. $ 23 $ — $ —

Building and inventory obtained in connection with foreclosure ........................................ $ 1,510 $ 751 $ —

Notes and accounts payable assumed in connection with foreclosure ..................................... $ 695 $ — $ —

Receivables cancelled in connection with foreclosure ................................................ $ 815 $ 500 $ —

Land and Building transferred for assumption of debt ................................................ $ — $ 835 $ —

The accompanying notes are an integral part of these consolidated financial statements.

51