eBay 1999 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 1999 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Provision for Income Taxes

The Company’s effective federal and state income tax rate was 11.2%, 38.7% and 46.2% in the years ended

December 31, 1997, 1998 and 1999, respectively. Prior to its acquisition in 1999, B&B had been taxed as an

S Corporation. In connection with its acquisition, B&B’s status as an S Corporation was terminated, and B&B

became subject to federal and state income taxes. The supplemental pro forma financial information presented in

the financial statements includes an increase to the provisions for income taxes based upon a combined federal

and state tax rate. This rate approximates the statutory tax rate which would have been applied if B&B had been

taxed as a C Corporation prior to its acquisition by eBay. The rate changes from 1997 to 1998 and from 1998 to

1999 both resulted from two primary factors, a larger portion of the revenue in each year was generated by eBay,

a C Corporation, and certain non-cash, non-deductible expenses as a percentage of pre-tax income. The Company

expects the consolidated effective tax rate to be at or near 42% during 2000.

Stock-Based Compensation

In connection with the grant of certain stock options and warrants from May 1997 through May 1999, the

Company recorded aggregate unearned compensation totaling $13.1 million, which is being amortized over the

four-year vesting period of the options and the one-year term of the warrant, respectively. Of the total unearned

compensation, approximately $25,000, $3.1 million and $4.7 million was amortized in 1997, 1998 and 1999

respectively. The Company expects stock based compensation expense of approximately $2.1 million in the year

ended December 31, 2000.

Liquidity and Capital Resources

Since inception, the Company has financed its operations primarily from net cash generated from operating

activities. The Company has obtained additional financing from the sale of preferred stock and warrants, proceeds

from the exercise of those warrants, proceeds from the exercise of stock options, and proceeds from its initial

and follow-on public offerings.

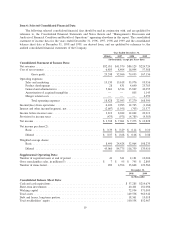

Net cash provided by operating activities was $11.6 million in 1997, $6.0 million in 1998 and $66.6 million

in 1999. Net cash provided by operating activities resulted primarily from the Company’s net income before non-

cash charges for amortization of unearned compensation, the provision for doubtful accounts, depreciation and

amortization, as well as increases in various liabilities, offset by partnership losses and changes in accounts

receivable.

Net cash used in investing activities totaled $3.0 million in 1997, $53.0 million in 1998, and $602.9 million

in 1999. Purchases of investments, property, equipment and intangibles was the primary use for invested cash in

all years presented, partially offset in 1998 by the sale of property and equipment. During 1998 and 1999,

proceeds from public offerings were used to purchase $40.4 million and $509.6 million of investments,

respectively.

Net cash provided by financing activities was $560,000 in 1997, $72.2 million in 1998 and $718.7 million

in 1999. During 1997, 1998 and 1999, the Company made distributions to B&B stockholders, but those amounts

were offset by debt and equity proceeds. The Company remained cash flow positive from financing activities

primarily due to the completion of its initial public offering in September 1998 and its follow-on offering in

April 1999. To a lesser extent, financing activities included the exercise of preferred stock warrants in 1998 and

B&B stockholders’ contributions during 1997, 1998 and 1999.

eBay had no material commitments for capital expenditures at December 31, 1999, but expects such

expenditures to be at least $60.0 million through December 31, 2000. Such expenditures will primarily be for

computer equipment, furniture and fixtures and leasehold improvements. eBay also has total minimum lease

obligations of $59.0 million under certain noncancellable operating leases and notes payable obligations of

$27.3 million through December 2004. In March 1999, eBay and AOL expanded the scope of their strategic

25