eBay 1999 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 1999 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

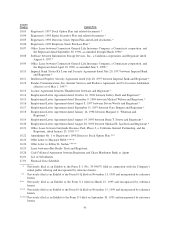

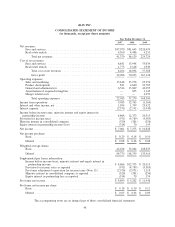

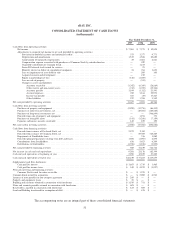

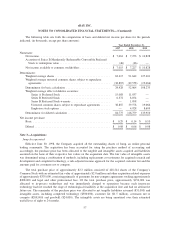

eBAY INC.

CONSOLIDATED STATEMENT OF INCOME

(in thousands, except per share amounts)

Year Ended December 31,

1997 1998 1999

Net revenues:

Fees and services .......................................... $37,070 $81,643 $220,493

Real estate rentals ......................................... 4,300 4,486 4,231

Total net revenues ...................................... 41,370 86,129 224,724

Cost of net revenues:

Fees and services .......................................... 6,631 13,948 55,639

Real estate rentals ......................................... 1,773 2,146 1,949

Total cost of net revenues ................................ 8,404 16,094 57,588

Gross profit .......................................... 32,966 70,035 167,136

Operating expenses:

Sales and marketing ........................................ 15,618 35,976 95,956

Product development ....................................... 831 4,640 23,785

General and administrative ................................... 6,534 15,849 43,055

Amortization of acquired intangibles ............................ — 805 1,145

Merger related costs ........................................ — — 4,359

Total operating expenses ................................. 22,983 57,270 168,300

Income from operations ......................................... 9,983 12,765 (1,164)

Interest and other income, net .................................... 1,054 1,799 23,422

Interest expense .............................................. (2,371) (2,191) (1,943)

Income before income taxes, minority interest and equity interest in

partnership income .......................................... 8,666 12,373 20,315

Provision for income taxes ...................................... (971) (4,789) (9,385)

Minority interest in consolidated company ........................... (320) (381) (256)

Equity interest in partnership income (loss) .......................... (314) 70 154

Net income .................................................. $ 7,061 $ 7,273 $ 10,828

Net income per share:

Basic ................................................... $ 0.29 $ 0.14 $ 0.10

Diluted ................................................. $ 0.08 $ 0.06 $ 0.08

Weighted average shares:

Basic ................................................... 24,428 52,064 108,235

Diluted ................................................. 84,775 116,759 135,910

Supplemental pro forma information:

Income before income taxes, minority interest and equity interest in

partnership income ....................................... $ 8,666 $12,373 $ 20,315

Provision for income taxes as reported .......................... (971) (4,789) (9,385)

Pro forma adjustment to provision for income taxes (Note 15) ......... (2,576) (2,071) 1,118

Minority interest in consolidated company as reported ............... (320) (381) (256)

Equity interest in partnership loss as reported ..................... (314) 70 154

Pro forma net income .......................................... $ 4,485 $ 5,202 $ 11,946

Pro forma net income per share:

Basic ................................................... $ 0.18 $ 0.10 $ 0.11

Diluted ................................................. $ 0.05 $ 0.04 $ 0.09

The accompanying notes are an integral part of these consolidated financial statements.

48