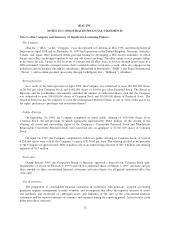

eBay 1999 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 1999 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

our service, resulting in reduced revenues. In addition, consumer ‘‘fads’’ may temporarily inflate the volume of

certain types of items listed on our service, placing a significant strain upon our infrastructure and transaction

capacity. These trends also may cause significant fluctuations in our operating results from one quarter to the

next. Any decline in demand for the goods offered through our service as a result of changes in consumer trends

could harm our business. A decline in consumer spending would harm our land-based auction businesses. Sales

of fine and decorative art, collectable cars and other collectibles would be adversely affected by a decline in

discretionary consumer spending, especially for luxury items. Changes in buyer’s tastes, economic conditions or

consumer trends could cause declines in the number or dollar volume of items sold and thereby harm the business

of these companies.

Some anti-takeover provisions may affect the price of our common stock

The Board of Directors has the authority to issue up to 10,000,000 shares of preferred stock and to

determine the preferences, rights and privileges of those shares without any further vote or action by the

stockholders. The rights of the holders of common stock may be harmed by the rights of the holders of any

preferred stock that may be issued in the future. Some provisions of our certificate of incorporation and bylaws

could have the effect of making it more difficult for a third party to acquire a majority of our outstanding voting

stock. These include provisions that provide for a classified Board of Directors, prohibit stockholders from taking

action by written consent and restrict the ability of stockholders to call special meetings. We are also subject to

provisions of Delaware law that prohibit us from engaging in any business combination with any interested

stockholder for a period of three years from the date the person became an interested stockholder, unless certain

conditions are met. This could have the effect of delaying or preventing a change of control.

We are controlled by certain stockholders, executive officers and directors

Our executive officers and directors (and their affiliates) own a majority of our outstanding common stock.

As a result, they have the ability to control our company and direct our affairs and business, including the

election of directors and approval of significant corporate transactions. This concentration of ownership may have

the effect of delaying, deferring or preventing a change in control of our company and may make some

transactions more difficult or impossible without the support of these stockholders. Any of these events could

decrease the market price of our common stock.

Item 7A: Quantitative and Qualitative Disclosures about Market Risk

Interest Rate Risk

The primary objective of eBay’s investment activities is to preserve principal while at the same time

maximizing yields without significantly increasing risk. To achieve this objective, the Company maintains its

portfolio of cash equivalents, short-term and long-term investments in a variety of securities, including both

government and corporate obligations and money market funds.

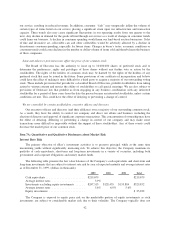

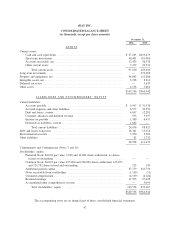

The following table presents the fair value balances of the Company’s cash equivalents and short-term and

long-term investments that are subject to interest rate risk by year of expected maturity and average interest rates

as of December 31, 1999, (dollars in thousands):

2000 2001 2002 Total

Cash equivalents ......................... $219,679 $219,679

Average interest rates ..................... 3.9%

Investments excluding equity investments ...... $247,513 $128,455 $153,884 $529,852

Average interest rates ..................... 5.6% 6.0% 5.6%

Equity investments ....................... $ 25,222

The Company is exposed to equity price risk on the marketable portion of equity investments as such

investments are subject to considerable market risk due to their volatility. The Company typically does not

42