XM Radio 1999 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 1999 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40 XM RADiO

approximately 8.6 million shares of AMSC’s common stock. Additionally, the Company issued an aggregate

$250.0 million of Series A subordinated convertible notes (see note 4(e)) to several new investors and used

$75.0 million of the proceeds it received from the issuance of these notes to redeem certain outstanding loan

obligations owed to WSI. As a result of these transactions, as of July 7, 1999, AMSC owned all of the issued

and outstanding stock of the Company. Concurrent with AMSC’s acquisition of the remaining interest in the

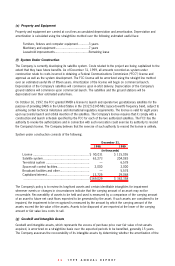

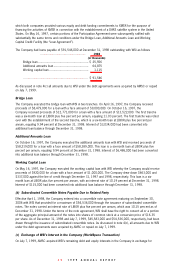

Company, the Company recognized goodwill and intangibles of $51,624,000, which has been allocated as

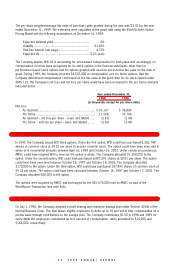

follows:

(in thousands)

FCC license .......................................................... $ 25,024

Goodwill ............................................................... 13,738

Programming agreements ..................................... 8,000

Receiver agreements ............................................ 4,600

Other intangibles................................................... 262

.......................................................................... $ 51,624

(d) Notes to Related Party

On January 15, 1999, the Company issued a convertible note maturing on September 30, 2006 to AMSC for

$21,419,000. This note carried an interest rate of LIBOR plus five percent per annum and was convertible at a

price of $16.35 per share. On July 7, 1999 the Company amended the convertible note agreement with AMSC

to change the maturity date to December 31, 2004, modified the conversion provisions to Class B common

stock at a price of $16.35 per share and the conversion of the accrued interest in Class B common stock at a

price of $9.52 per share.

Following the WorldSpace Transaction, the Company issued a convertible note maturing December 31, 2004 to

AMSC for $81,676,000 in exchange for the $54,536,000 subordinated convertible notes payable, $6,889,000

in demand notes, $20,251,000 in accrued interest and all of WSI’s outstanding options to acquire the

Company’s common stock. This note bore interest at LIBOR plus five percent per annum. The note was

convertible at AMSC’s option at $8.65 per Class B common share. The Company took a one-time $5,520,000

charge to interest due to the beneficial conversion feature of the new AMSC note.

These notes, along with $3,870,000 of accrued interest were converted into 11,182,926 shares of Class B

common stock upon the initial public offering.

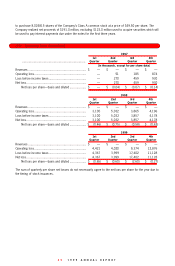

(e) Issuance of Series A Subordinated Convertible Notes of the Company to New Investors

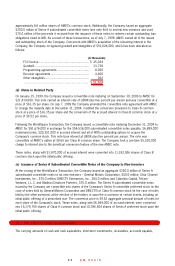

At the closing of the WorldSpace Transaction, the Company issued an aggregate $250.0 million of Series A

subordinated convertible notes to six new investors – General Motors Corporation, $50.0 million; Clear Channel

Investments, Inc., $75.0 million; DIRECTV Enterprises, Inc., $50.0 million; and Columbia Capital, Telcom

Ventures, L.L.C. and Madison Dearborn Partners, $75.0 million. The Series A subordinated convertible notes

issued by the Company are convertible into shares of the Company’s Series A convertible preferred stock (in the

case of notes held by General Motors Corporation and DIRECTV) or Class A common stock (in the case of notes

held by the other investors) at the election of the holders or upon the occurrence of certain events, including an

initial public offering of a prescribed size. The conversion price is $9.52 aggregate principal amount of notes for

each share of the Company’s stock. These notes, along with $6,849,000 of accrued interest, were converted

into 16,179,755 shares of Class A common stock and 10,786,504 shares of Series A preferred stock upon the

initial public offering.

(5) Fair Value of Financial Instruments

The carrying amounts of cash and cash equivalents, short-term investments, receivables, accounts payable,