XM Radio 1999 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 1999 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22 XM RADiO

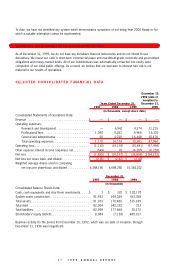

Interest Expense. As of December 31, 1998 and 1997, we owed $140.2 million and $82.5 million,

respectively, including accrued interest, under various debt agreements which we entered into for the purpose of

financing the XM Radio system. We capitalized interest costs of $11.8 million and $1.9 million associated with

our FCC license and the XM Radio system during the year ended December 31, 1998 and 1997, respectively.

We expensed interest costs of $0.5 million during the year ended December 31, 1997.

Net Loss. The net loss for the years ended December 31, 1998 and 1997 was $16.2 million and $1.7 million,

respectively, primarily reflecting research and development activities, professional fees and general and

administrative expenses.

Liquidity and Capital Resources

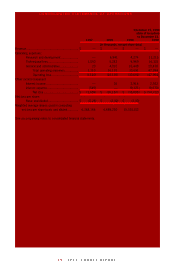

At December 31, 1999, we had a total of cash, cash equivalents and short-term investments of $120.2 million and

working capital of $94.7 million, compared with cash and cash equivalents of $0.3 million and working capital of

$(130.3) million at December 31, 1998. The increases in the respective balances are due primarily to the proceeds

from the issuance of Series A subordinated convertible notes in July 1999 (see “Management’s Discussion and

Analysis of Financial Condition and Results of Operations – Funds Required for XM Radio Through Commencement

of Commercial Operations – Sources of Funds”) exceeding capital expenditures and operating expenses for 1999,

which was off-set by a $75.0 million payment to retire loans payable, and the conversion of current loans payable to

a former shareholder into the non-current American Mobile new convertible note. In October 1999, we successfully

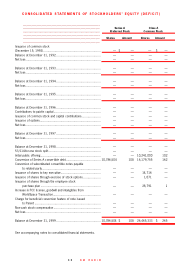

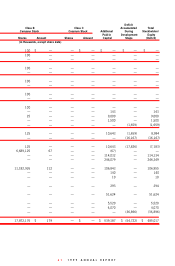

completed an initial public offering, which raised $114.1 million in net proceeds, and converted the Series A

subordinated convertible notes into Series A convertible preferred stock and Class A common stock.

Funds Required for XM Radio Through Commencement of Commercial Operations

We estimate that we will require approximately $1.1 billion to develop and implement the XM Radio system from

our inception through the commencement of commercial operations, which we are targeting for the second

quarter of 2001. We have raised an aggregate of $865.0 million since our inception net of expenses, interest

reserve and repayment of debt. We will require substantial additional funding, approximately $235.0 million, to

finish building the XM Radio system, to provide working capital and fund operating losses until we commence

commercial operations. The funds raised to date are expected to be sufficient in the absence of additional

financing to cover our funding needs into the third quarter of 2000.

We currently expect to satisfy our funding requirements by selling debt or equity securities and by obtaining

loans or other credit lines from banks or other financial institutions. In addition, we plan to raise funds through

vendor financing arrangements associated with our terrestrial repeater project. If we are successful in raising

additional financing, we anticipate that a significant portion of future financing will consist of debt. We are

actively considering possible financings, and because of our substantial capital needs we may consummate one

or more financings at any time. Often, high yield debt securities are issued as part of units with warrants to

purchase common stock. If warrants were issued in any debt placement by us, the amount of common stock

that may be purchased and the price at which stock would be purchased under the warrants would depend upon

market conditions at that time.

American Mobile is our controlling stockholder. American Mobile has certain rights regarding the election of

persons to serve on our board of directors and as of the date of this report, holds 61.0% of the voting power of

Holdings, or 50.5% giving effect to the conversion of all of Holdings’ outstanding common stock equivalents.

American Mobile cannot relinquish its position as our controlling shareholder without obtaining the prior approval

of the FCC. Accordingly, prior to our obtaining FCC approval of the transfer of control from American Mobile, we

will only be able to issue a limited amount of voting securities or securities convertible into voting securities

unless certain of our stockholders holding nonvoting convertible securities agree not to convert them into voting

securities or we take other steps to permit voting securities on a basis consistent with FCC rules. Certain

holders of our nonvoting securities have agreed not to convert their securities if it would cause American Mobile

not to hold a majority of our voting stock or a lesser percentage approved by the FCC, until we obtain approval