XM Radio 1999 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 1999 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28 XM RADiO

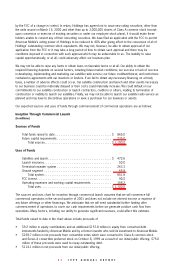

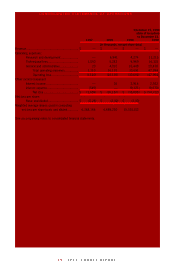

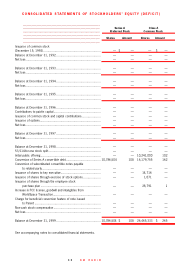

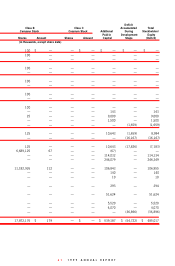

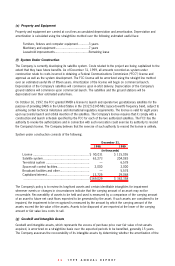

CONSOLiDATED BALANCE SHEETS

1998 1999

(in thousands, except

share data)

ASSETS

Current assets:

Cash and cash equivalents...................................................................... $ 310 $ 50,698

Short-term investments........................................................................... — 69,472

Prepaid and other current assets............................................................. 172 1,077

Total current assets ....................................................................... 482 121,247

Other assets:

System under construction ..................................................................... 169,029 362,358

Property and equipment, net of accumulated depreciation and

amortization of $57 and $347 ........................................................... 449 2,551

Goodwill and intangibles, net of accumulated amortization of $0

and $1,220........................................................................................ — 25,380

Other assets .......................................................................................... 525 3,653

Total assets................................................................................... $ 170,485 $ 515,189

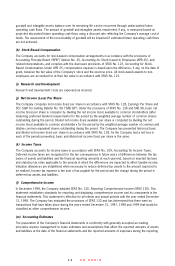

LiABiLiTiES AND STOCKHOLDERS' EQUiTY (DEFiCiT)

Current liabilities:

Accounts payable................................................................................... $ 23,125 $ 23,338

Accrued expenses.................................................................................. 444 1,514

Due to related parties............................................................................. 13,767 62

Accrued interest on loans payable........................................................... 1,907 —

Loans payable due to related parties....................................................... 91,546 —

Royalty payable...................................................................................... — 1,646

Term loan .............................................................................................. 34 —

Total current liabilities..................................................................... 130,823 26,560

Term loan, net of current portion .................................................................... 53 —

Subordinated convertible notes payable due to related party............................ 45,583 —

Accrued interest on subordinated convertible notes payable due to related party 1,209 —

Royalty payable, net of current portion ........................................................... — 3,400

Capital lease, net of current portion................................................................ — 212

Total liabilities ................................................................................ 177,668 30,172

Stockholders’ equity (deficit):

Preferred stock, par value $0.01; 60,000,000 shares authorized,

15,000,000 shares designated Series A, no shares and 10,786,504

issued and outstanding at December 31, 1998 and 1999..................... — 108

Class A common stock, par value $0.01; 180,000,000 shares authorized,

no and 26,465,333 shares issued and outstanding at

December 31, 1998 and 1999 ........................................................... — 265

Class B common stock, par value $0.01; 30,000,000 shares authorized,

125 (6,689,250 post split) and 17,872,176 shares issued and

outstanding at December 31, 1998 and 1999..................................... — 179

Class C common stock, par value $0.01; 30,000,000 shares authorized,

no shares issued and outstanding at December 31, 1998 and 1999 ..... — —

Additional paid-in capital.......................................................................... 10,643 539,187

Deficit accumulated during development stage......................................... (17,826) (54,722)

Total stockholders’ equity (deficit).................................................... (7,183) 485,017

Commitments and contingencies (notes 11 and 12):

Total liabilities and stockholders’ equity (deficit)............................... $ 170,485 $ 515,189

See accompanying notes to consolidated financial statements.