Washington Post 1999 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 1999 Washington Post annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

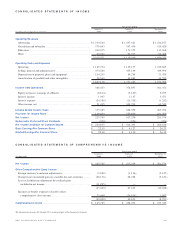

and a slight increase in volume. Classified advertising revenues at

The Washington Post increased 5 percent primarily due to higher

rates and higher recruitment volume. Retail advertising revenues at

The Post declined 3 percent primarily as a result of a 7.5 percent

decline in inches. Other advertising revenues (including general and

preprint) at The Post increased 11 percent; general advertising vol-

ume was essentially unchanged for 1998; however, preprint volume

increased 6 percent.

Circulation revenues for the newspaper division remained

essentially unchanged from 1997, with the extra week in 1998

offsetting the effects of a 1.3 percent decline in daily and Sunday

circulation at The Washington Post.

Newspaper division operating margin in 1998 decreased to 16

percent, from 19 percent in 1997. The decrease in 1998 operating

margin is primarily attributable to increased costs arising from the

expansion of the printing facilities of The Washington Post, a 10

percent increase in newsprint costs, and increased electronic media

spending for the continued development of washingtonpost.com. The

10 percent increase in newsprint costs is comprised of a 4 percent

increase in newsprint consumed (driven primarily by expanded sub-

urban community coverage at The Washington Post) and a 6 percent

increase in newsprint prices.

Television Broadcasting Division. Revenues at the broadcast division

rose 6 percent to $357.6 million in 1998, compared to $338.4 mil-

lion in 1997. The increase in revenues is primarily attributable to

1998 political advertising and increased local advertising revenues.

Competitive market position remained strong for the Company’s

television stations. In the November 1998 Nielsen ratings book,

WDIV, WJXT and KSAT continued to rank number one in audience

share sign-on to sign-off, while WPLG tied for first place among

English-language stations in the Miami market. KPRC, although

still ranked third in the market, has narrowed the gap significantly

and now challenges its closest competitors by as little as two audi-

ence share points. WKMG, which the broadcast division took over

in September 1997, has remained in third place in Orlando while

moving aggressively to build a strong news franchise.

The operating margin at the broadcast division was 48 percent

in 1998 and 1997. Excluding amortization of goodwill and intangi-

bles, the operating margin was 52 percent in 1998 and 1997.

Magazine Publishing Division. Magazine division revenues rose 2 per-

cent to $399.5 million, from $389.9 million in 1997. The increase

in revenue is attributable to revenue contributed by the business

information trade periodicals acquired in December 1997, offset

partially by a decline in revenue at Newsweek. Advertising revenues

at Newsweek declined 7 percent primarily as the result of two fewer

Newsweek domestic special issues in 1998 versus 1997 and softness

in advertising at the international editions of Newsweek (particu-

larly the Asian and Latin American editions). Total circulation

revenue for the magazine division decreased 6 percent in 1998 due

predominantly to the newsstand sales of two Newsweek domestic

edition special issues in 1997, which were not recurring in 1998,

as well as currency deflation at most of the international editions

of Newsweek.

Operating margin at the magazine division was 11 percent in

both 1998 and 1997. The 2 percent increase in 1998 revenues com-

bined with an increase in the pension credit at Newsweek were offset

by normal expense growth and the amortization expense arising from

the December 1997 acquisition of the business unit trade periodicals.

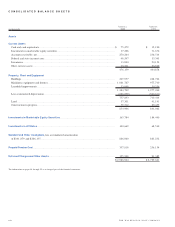

Cable Division. Revenues at the cable division increased 16 percent

to $298.0 million in 1998, from $257.7 million in 1997. Basic,

tier, pay and advertising revenue categories showed improvement

over 1997. Increased subscribers in 1998, primarily from acquisi-

tions, and higher rates accounted for most of the 15 percent

increase in subscriber revenues. The number of basic subscribers at

the end of the year increased to 733,000, from 637,300 at the end

of 1997. During 1998, the cable division acquired cable systems

serving approximately 115,400 subscribers and sold cable systems

serving approximately 29,000 subscribers.

Operating margin at the cable division was 22 percent in

1998, compared to 21 percent in 1997. Cable operating cash flow

increased 21 percent to $126.5 million, from $104.7 million in

1997. Approximately 40 percent of the 1998 improvement in oper-

ating cash flow is attributable to the results of cable systems

acquired in 1998 and 1997.

Education and Career Services Division. The education and career

services division’s 1998 revenues totaled $194.9 million, a 66 per-

cent increase over 1997 (with acquisitions accounting for approxi-

mately two-thirds of the increase). The remaining growth in revenue

was primarily generated by the traditional test preparation and

SCORE! businesses. Operating losses totaled $7.5 million for 1998,

compared to $8.4 million in 1997. The 1998 operating results

reflect improvements in operating income arising from the tradi-

tional test preparation business and acquisitions, offset by start-up

costs associated with the opening of new SCORE! centers.

Other Businesses and Corporate Office. Revenues from other businesses,

including Legi-Slate, MLJ (sold in July 1998) and PASS Sports

(nine months of 1997) totaled $11.5 million in 1998, compared to

$38.8 million in 1997. The decline in revenue is due to the sale of

PASS and MLJ.

Other businesses and the corporate office recorded an operating

loss in 1998 of $33.4 million, compared to a loss of $25.8 million

in 1997.

36 THE WASHINGTON POST COMPANY