Washington Post 1999 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 1999 Washington Post annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

as well as increased spending for HireSystems and the development

of various distance learning initiatives, offset in part by operating

income improvements in the traditional test preparation business.

Other Businesses and Corporate Office. For 1999, other businesses

and corporate office includes the expenses associated with the

Company’s corporate office and the operating results of Legi-Slate

through June 30, 1999, the date of its sale. For 1998, other busi-

nesses and corporate office includes the Company’s corporate office,

the operating results of Legi-Slate, and the results of MLJ through

July 1998, the date of its sale.

Revenue for other businesses totaled $3.8 million and $11.5

million in 1999 and 1998, respectively. Operating losses for other

businesses and corporate office were $27.1 million for 1999 and

$33.4 million for 1998. The decrease in operating losses in 1999

is due to the absence of full-year operating losses of MLJ (sold in

July 1998) and Legi-Slate (sold in June 1999).

Equity in Losses of Affiliates. The Company’s equity in losses of affili-

ates in 1999 was $8.8 million, compared to losses of $5.1 million

in 1998. The Company’s affiliate investments consists primarily of

a 54 percent non-controlling interest in BrassRing (formed in late

September 1999), a 50 percent interest in the International Herald

Tribune, and a 49 percent interest in Bowater Mersey Paper

Company Limited. The decline in 1999 affiliate results is primarily

attributable to BrassRing, Inc., which is in the development and

marketing phase of its operations.

Non-Operating Items. In 1999, the Company incurred net interest

expense of $25.7 million, compared to $10.4 million of net interest

expense in 1998. The 1999 increase in net interest expense is

attributable to borrowings executed by the Company to fund capital

improvements, acquisition activities and share repurchases.

The Company recorded other non-operating income of $21.4

million in 1999, compared to $304.7 million in 1998. The

Company’s 1999 other non-operating income consists principally of

gains on the sale of marketable equity securities (mostly various

Internet-related securities). The Company’s 1998 other non-operat-

ing income consisted mostly of the non-recurring gains resulting

from the Company’s disposition of its 28 percent interest in Cowles

Media Company, sale of 14 small cable systems and disposition of

its investment interest in Junglee.

Income Taxes. The effective tax rate in 1999 was 39.9 percent, as

compared to 37.5 percent in 1998. The increase in the effective

tax rate is principally due to the 1998 disposition of Cowles Media

Company being subject to state income tax in jurisdictions

with lower tax rates.

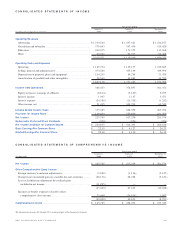

RESULTS OF OPERATIONS —1998 COMPARED TO 1997

Net income in 1998 was $417.3 million, an increase of 48 percent

over net income of $281.6 million in 1997. Basic and diluted

earnings per share both rose 57 percent to $41.27 and $41.10,

respectively, in 1998. The Company’s 1998 net income includes

$194.4 million from the disposition of the Company’s 28 percent

interest in Cowles Media Company, the sale of 14 small cable sys-

tems and the disposition of the Company’s investment interest in

Junglee, a facilitator of Internet commerce. The Company’s 1997

net income includes $44.5 million from the sale of the Company’s

investment in Bear Island Paper Company, L.P., and Bear Island

Timberlands Company, L.P., and the sale of the assets of its PASS

regional cable sports network. Excluding these non-recurring gains,

net income decreased 6 percent in 1998 and basic and diluted earn-

ings per share remained essentially unchanged with fewer average

shares outstanding.

Revenues for 1998 totaled $2,110.4 million, an increase of

8 percent from $1,956.3 million in 1997. Advertising revenues

increased 5 percent in 1998, and circulation and subscriber revenues

increased 5 percent. Education revenues increased 46 percent in

1998 and other revenues increased 14 percent. The newspaper and

broadcast divisions generated most of the increase in advertising

revenues. The increase in circulation and subscriber revenues is

primarily due to a 15 percent increase in subscriber revenues at the

cable division (arising mostly from cable system acquisitions in 1998

and 1997). Revenue growth at Kaplan, Inc. (about two-thirds of which

was from acquisitions) accounted for the increase in education revenues.

Operating costs and expenses for the year increased 10 percent

to $1,731.5 million, from $1,574.9 million in 1997. The cost and

expense increase is primarily due to companies acquired in 1998

and 1997, increased spending for new media activities, a 10 percent

increase in newsprint expense, and expenses arising from the expan-

sion of the printing facilities of The Washington Post. These expense

increases were partially offset by an increase in the Company’s

pension credit.

Operating income decreased 1 percent to $378.9 million in

1998, from $381.4 million in 1997.

The Company’s 1998 operating income includes $62.0 million

of net pension credits, compared to $30.2 million in 1997.

Division Results

Newspaper Publishing Division. At the newspaper division, 1998

included 53 weeks as compared to 52 weeks in 1997. Newspaper

division revenues increased 4 percent to $848.9 million, from

$814.3 million in 1997. Advertising revenues at the newspaper divi-

sion rose 5 percent over the previous year. At The Washington Post,

advertising revenues increased 4 percent as a result of higher rates

35THE WASHINGTON POST COMPANY