Washington Post 1999 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 1999 Washington Post annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

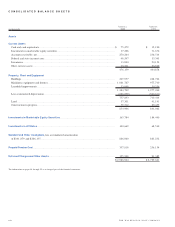

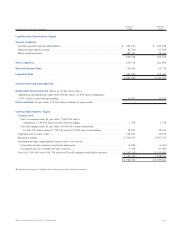

CONSOLIDATED STATEMENTS OF CASH FLOWS

Fiscal year ended

January 2, January 3, December 28,

(in thousands) 2000 1999 1997

Cash Flows from Operating Activities:

Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $225,785 $ 417,259 $ 281,574

Adjustments to reconcile net income to net cash provided by

operating activities:

Depreciation of property, plant and equipment . . . . . . . . . . . . . . . . . . . . . . 104,235 89,248 71,478

Amortization of goodwill and other intangibles . . . . . . . . . . . . . . . . . . . . . . 58,563 49,889 33,559

Net pension benefit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (81,683) (61,997) (30,227)

Gain from disposition of businesses and

marketable equity securities, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (38,799) (314,400) (44,560)

Equity in losses (earnings) of affiliates, net of distributions . . . . . . . . . 9,744 9,145 (6,996)

Provision for deferred income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29,988 26,987 3,089

Change in assets and liabilities:

(Increase) decrease in accounts receivable, net . . . . . . . . . . . . . . . . . . . (28,194) 22,041 (8,438)

Decrease (increase) in inventories . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6,264 (941) 5,214

(Decrease) increase in accounts payable and accrued liabilities . . . (7,749) 13,949 19,638

Increase in income taxes receivable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2,909) (50,735) —

(Increase) decrease in other assets and other liabilities, net . . . . . . (4,274) 12,241 2,690

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12,034 10,427 (8,724)

Net cash provided by operating activities ......................... 283,005 223,113 318,297

Cash Flows from Investing Activities:

Net proceeds from sale of businesses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,000 376,442 120,208

Purchases of property, plant and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . (130,045) (244,219) (214,573)

Purchases of marketable equity securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (23,332) (164,955) —

Sales and maturities of marketable equity securities . . . . . . . . . . . . . . . . . . 54,805 38,246 —

Investments in certain businesses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (90,455) (320,597) (178,943)

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (13,356) (5,960) (3,187)

Net cash used in investing activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (200,383) (321,043) (276,495)

Cash Flows from Financing Activities:

Issuance of commercial paper, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34,087 156,968 296,394

Issuance of notes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 397,620 — —

Redemption of redeemable preferred stock . . . . . . . . . . . . . . . . . . . . . . . . . . . . —(74) —

Dividends paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (53,326) (51,383) (52,592)

Common shares repurchased . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (425,865) (20,512) (368,565)

Proceeds from exercise of stock options . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25,151 7,004 1,800

Net cash (used in) provided by financing activities ................. (22,333) 92,003 (122,963)

Net Increase (Decrease) in Cash and Cash Equivalents . . . . . . . . . . . . . . . . 60,289 (5,927) (81,161)

Cash and Cash Equivalents at Beginning of Year . . . . . . . . . . . . . . . . . . . . . . 15,190 21,117 102,278

Cash and Cash Equivalents at End of Year ................................ $75,479 $ 15,190 $ 21,117

Supplemental Cash Flow Information:

Cash paid during the year for:

Income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $125,000 $ 280,000 $ 164,000

Interest, net of amounts capitalized . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $16,000 $ 8,700 $ 350

The information on pages 44 through 55 is an integral part of the financial statements.

42 THE WASHINGTON POST COMPANY