Washington Post 1999 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 1999 Washington Post annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

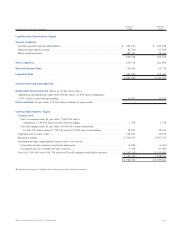

This analysis should be read in conjunction with the consolidated

financial statements and the notes thereto.

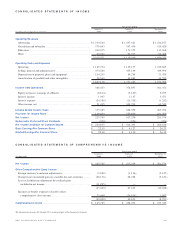

RESULTS OF OPERATIONS —1999 COMPARED TO 1998

Net income in 1999 was $225.8 million, compared with net

income of $417.3 million for 1998. Basic and diluted earnings per

share totaled $22.35 and $22.30 in 1999, respectively, compared

to $41.27 and $41.10 in 1998. The Company’s 1998 net income

includes $194.4 million from the disposition of the Company’s

28 percent interest in Cowles Media Company, the sale of 14 small

cable systems and the disposition of the Company’s investment in

Junglee, a facilitator of Internet commerce. Excluding the effect of

these one time items from 1998 net income, the Company’s 1999

net income of $225.8 million increased 1 percent, from net income

of $222.9 million in 1998. On the same basis of presentation, diluted

earnings per share for 1999 of $22.30 increased 2 percent compared

to $21.90 in 1998, with fewer average shares outstanding.

Revenues for 1999 totaled $2,215.6 million, an increase of 5 per-

cent from $2,110.4 million in 1998. Advertising revenues increased

3 percent in 1999, and circulation and subscriber revenues increased

6 percent. Education revenues increased 40 percent in 1999, and other

revenues decreased 31 percent. The newspaper and magazine divisions

generated most of the increase in advertising revenues. The increase

in circulation and subscriber revenues is primarily due to a 13 percent

increase in subscriber revenues at the cable division. Revenue growth

at Kaplan, Inc. (about two-thirds of which was from acquisitions)

accounted for the increase in education revenues. The decline in other

revenues is principally due to the disposition of MLJ (July 1998) and

Legi-Slate (June 1999).

Operating costs and expenses for the year increased 6 percent

to $1,827.1 million, from $1,731.5 million in 1998. The cost and

expense increase is primarily due to companies acquired in 1999 and

1998, greater spending for Internet-related businesses (approxi-

mately $34 million increase), higher depreciation and amortization

expense and increased spending for new business initiatives at the

education and career services division. These expense increases were

offset in part by a 19 percent decline in newsprint expense and an

increase in the Company’s pension credit.

Operating income increased 3 percent to $388.5 million in

1999, from $378.9 million in 1998.

The Company’s 1999 operating income includes $81.7 million

of net pension credits, compared to $62.0 million in 1998.

Division Results. The Company now includes the results of its elec-

tronic media publishing operations (primarily washingtonpost.com)

within the newspaper publishing division. Previously, these operating

results were included in the “other businesses and corporate office”

segment. All prior year division results have been restated to reflect

this change in reporting.

Newspaper Publishing Division. At the newspaper division, 1999

included 52 weeks, compared to 53 weeks in 1998. Newspaper divi-

sion revenues increased 3 percent to $875.1 million, from $848.9

million in 1998. Advertising revenues at the newspaper division rose

5 percent over the previous year. At The Washington Post, advertis-

ing revenues increased 3 percent as a result of higher rates and

volume. Classified advertising revenues at The Washington Post

increased 2 percent primarily due to higher rates. Retail advertising

revenues at The Post remained essentially even with the previous

year. Other advertising revenues (including general and preprint) at

The Post increased 7 percent due mainly to increased general adver-

tising volume and higher rates.

Circulation revenues for the newspaper division declined by

3percent in 1999 due primarily to the extra week in 1998 versus

1999. At The Washington Post, daily circulation for 1999 remained

essentially even with 1998; Sunday circulation declined by 1 percent.

Newspaper division operating margin in 1999 increased to

18 percent, from 16 percent in 1998. The improvement in operating

margin resulted mostly from an improvement in the operating

results of The Washington Post, offset in part by increased elec-

tronic media spending for the continued development of washington-

post.com. The Post’s 1999 operating results benefited from the

higher advertising revenues discussed above, a 19 percent reduction

in newsprint expense and larger pension credits ($28.0 million in

1999 versus $19.0 million in 1998). These operating income

improvements were offset in part by higher depreciation expense

(arising from the recently completed expansion of The Post’s

printing facilities) and other general expense increases including

increased promotion and marketing.

Television Broadcasting Division. Revenues at the broadcast division

declined 4 percent to $341.8 million in 1999, compared to $357.6

million in 1998. The decline in 1999 revenues is due to softness in

national advertising revenues and the absence of Winter Olympic

advertising revenues (first quarter of 1998) and political advertising

revenues (third and fourth quarter of 1998), offset in part by growth

in local advertising revenues.

Competitive market position remained strong for the Company’s

television stations. WJXT in Jacksonville and KSAT in San Antonio

continued to be ranked number one in the latest ratings period, sign-

on to sign-off, in their markets; WPLG in Miami achieved the top

ranking among English-language stations in the Miami market;

WDIV in Detroit was ranked second in the Detroit market with very

little distance between it and the first place ranking; and KPRC in

33THE WASHINGTON POST COMPANY

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS OF OPERATIONS

AND FINANCIAL CONDITION