Washington Post 1999 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 1999 Washington Post annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

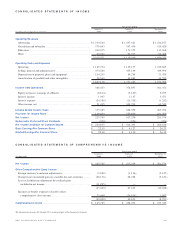

Houston and WKMG in Orlando ranked third in their respective mar-

kets but continued to make good progress in improving market share.

The operating margin at the broadcast division was 49 percent in

1999, compared to 48 percent in 1998. Excluding amortization of

goodwill and intangibles, the operating margin was 53 percent in 1999

and 52 percent in 1998. The improvement in 1999 operating margin

is attributable to 1999 expense control initiatives, the benefits of which

were offset in part by the decline in national advertising revenues.

Magazine Publishing Division. Magazine division revenues were

$401.1 million for 1999, up slightly over 1998 revenues of

$399.5 million. Operating income for the magazine division totaled

$62.1 million in 1999, an increase of 39 percent over operating

income of $44.5 million in 1998. The 39 percent increase in operat-

ing income is primarily attributable to the operating results of

Newsweek. At Newsweek, operating income improved as a result of

an increase in the number of advertising pages at the domestic edi-

tion, higher pension credits ($48.3 million in 1999 versus $35.9

million in 1998) and a reduction in other operating expenses.

Offsetting these improvements were the effects of a decline in adver-

tising revenues at the Company’s trade periodicals unit.

Operating margin of the magazine division increased to 15 per-

cent in 1999, from 11 percent in 1998.

Cable Division. Revenues at the cable division increased 13 percent

to $336.3 million in 1999, from $298.0 million in 1998. Basic,

tier, pay and advertising revenue categories showed improvement

over 1998. Increased subscribers in 1999, primarily from acquisi-

tions, and higher rates accounted for most of the increase in rev-

enues. The number of basic subscribers at the end of the year

increased to 739,850 from 733,000 at the end of 1998.

Operating margin at the cable division before amortization

expense was 29 percent for 1999, compared to 30 percent for

1998. The decline in operating margin is primarily attributable to a

16 percent increase in depreciation expense arising from system

rebuilds and upgrades, offset in part by higher revenues. Cable oper-

ating cash flow increased 11 percent to $140.2 million, from

$126.5 million in 1998. Approximately 70 percent of the 1999

improvement in operating cash flow is due to the results of cable

systems acquired in 1999 and 1998.

Education and Career Services Division. The Company provides educa-

tion and career services through its subsidiary Kaplan, Inc. Kaplan

provides test preparation programs in the U.S. and abroad for indi-

viduals taking admissions and professional licensing exams. Kaplan

also provides on-site educational programs to students and teachers

at elementary, secondary and post-secondary institutions, and offers

a growing number of distance learning programs. In addition,

Kaplan publishes books, software and other materials.

Kaplan also owns SCORE! Learning Corporation, a provider of

after-school learning opportunities for students in kindergarten

through the twelfth grade. SCORE! presently operates 100 SCORE!

Educational Centers (most opened within the last two years) and

plans to open an additional 45 centers in 2000. In September 1999,

SCORE! announced the launch of a new e-commerce site,

eSCORE.com, to provide customized online educational resources

and services to parents and children.

For the first nine months of 1999 and all of 1998, Kaplan,

through its career services division, was the leading provider of

career fairs in North America, bringing together technical, sales

and diversity candidates with corporate recruiters. Kaplan, through

its subsidiary HireSystems, also provided corporate clients with

web-based tools to streamline the recruitment and hiring process.

On September 29, 1999, Kaplan contributed its ownership of these

two businesses to a newly formed company named BrassRing, Inc.

(BrassRing). Partnering with Kaplan in the formation of this new

business are the Tribune Company and Accel Partners, which each

contributed cash and/or other assets to BrassRing. From September

30, 1999, the operating results of the career fair businesses and

HireSystems have been included in BrassRing, of which the

Company records its 54 percent non-controlling interest in accor-

dance with the equity method of accounting.

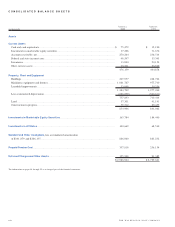

Excluding the operating results of the career fair and

HireSystems businesses, the 1999 revenues for the education and

career services division totaled $240.1 million, a 40 percent

increase from 1998 revenues of $171.4 million. Approximately

two-thirds of the 1999 revenue increase is attributable to businesses

acquired in 1999 and 1998. The remaining increase in revenue

is due to growth in the test preparation and SCORE! businesses.

Operating losses for 1999 totaled $17.4 million, compared to

$6.0 million in 1998. The decline in 1999 operating results is

primarily attributable to the opening of new SCORE! centers,

start-up costs associated with eSCORE.com and the development

of various distance learning initiatives, offset in part by operating

income improvements in the traditional test preparation business.

Including the results of the career fair businesses and

HireSystems, the education and career services division’s 1999 rev-

enues totaled $257.5 million, a 32 percent increase over the same

period in the prior year. Approximately two-thirds of the increase

is due to business acquisitions completed in 1999 and 1998. The

remaining increase in 1999 revenue is due to growth in the test

preparation business and SCORE! businesses. Division operating

losses of $38.0 million represent a $30.5 million increase in

operating losses from 1998. The decline in 1999 operating results

is primarily attributable to start-up costs associated with opening

new SCORE! centers and the launch of the eSCORE.com web site,

34 THE WASHINGTON POST COMPANY