Washington Post 1999 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 1999 Washington Post annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

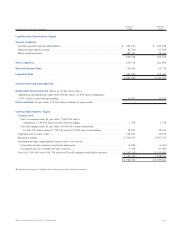

for issuance under the incentive compensation plan. Of this number,

31,360 shares were subject to awards outstanding, and 58,900

shares were available for future awards. Activity related to stock

awards under the long-term incentive compensation plan for the

years ended January 2, 2000, January 3, 1999 and December 28,

1997 was as follows:

1999 1998 1997

Number Average Number Average Number Average

of Award of Award of Award

Shares Price Shares Price Shares Price

Awards Outstanding

Beginning of year ... 30,730 $ 405.40 32,331 $ 281.19 30,490 $ 237.83

Awarded ......... 2,615 543.02 14,120 522.56 18,285 351.68

Vested ........... (167) 349.00 (15,075) 244.10 (13,521) 228.96

Forfeited ........ (1,818) 479.90 (646) 293.83 (2,923) 285.35

End of year ........ 31,360 $ 412.86 30,730 $ 405.40 32,331 $ 281.19

In addition to stock awards granted under the long-term incen-

tive compensation plan, the Company also made stock awards of

1,750 shares in 1999, 938 shares in 1998, and 2,000 shares in 1997.

For the share awards outstanding at January 2, 2000, the

aforementioned restriction will lapse in 2000 for 100 shares, 2001

for 17,683 shares, 2002 for 1,371 shares, 2003 for 15,794 shares,

and 2004 for 1,100 shares. Stock-based compensation costs resulting

from stock awards reduced net income by $2.2 million ($0.22 per

share, basic and diluted), $1.9 million ($0.19 per share, basic and

diluted), and $1.2 million ($0.11 per share, basic and diluted) in

1999, 1998 and 1997, respectively.

Stock Options. The Company’s employee stock option plan, which

was adopted in 1971 and amended in 1993, reserves 1,900,000

shares of the Company’s Class B common stock for options to be

granted under the plan. The purchase price of the shares covered

by an option cannot be less than the fair value on the granting date.

At January 2, 2000, there were 524,000 shares reserved for

issuance under the stock option plan, of which 156,497 shares

were subject to options outstanding and 367,503 shares were

available for future grants.

Changes in options outstanding for the years ended January 2,

2000, January 3, 1999 and December 28, 1997 were as follows:

1999 1998 1997

Number Average Number Average Number Average

of Option of Option of Option

Shares Price Shares Price Shares Price

Beginning

of year ........ 246,072 $ 404.48 251,225 $ 371.35 178,625 $ 270.21

Granted ........ 3,750 516.36 25,500 519.32 80,200 583.62

Exercised ....... (87,825) 288.43 (30,653) 228.53 (7,600) 234.20

Forfeited ....... (5,500) 450.86 — — — —

End of year ....... 156,497 $ 470.64 246,072 $ 404.48 251,225 $ 371.35

Of the shares covered by options outstanding at the end of 1999,

109,022 are now exercisable, 22,342 will become exercisable in

2000, 17,925 will become exercisable in 2001, 6,625 will become

exercisable in 2002, and 583 will become exercisable in 2003.

Information related to stock options outstanding at January 2,

2000 is as follows:

Weighted

average Weighted Weighted

Number remaining average Number average

Range of outstanding contractual exercise exercisable exercise

exercise prices at 1/2/00 life (yrs.) price at 1/2/00 price

$173 5,000 2.0 $ 173.00 5,000 $ 173.00

222-299 30,675 4.3 247.70 30,675 247.70

344-350 17,497 7.1 344.44 12,347 344.29

472 41,575 8.0 472.00 20,000 472.00

509-570 26,750 9.1 519.10 6,000 520.70

733 35,000 8.0 733.00 35,000 733.00

All options were granted at an exercise price equal to or greater

than the fair market value of the Company’s common stock at the

date of grant. The weighted-average fair value for options granted

during 1999, 1998 and 1997 was $157.77, $126.57 and $87.94,

respectively. The fair value of options at date of grant was estimated

using the Black-Scholes method utilizing the following assumptions:

1999 1998 1997

Expected life (years) .................... 777

Interest rate.............................. 6.19% 4.68% 5.84%

Volatility................................. 16.0% 14.6% 14.2%

Dividend yield ........................... 1.1% 1.2% 1.5%

Had the fair values of option granted after 1995 been recog-

nized as compensation expense, net income would have been reduced

by $1.9 million ($0.19 per share, basic and diluted), $2.0 million

($0.19 per share, basic and diluted) and $1.6 million ($0.15 per share,

basic and diluted) in 1999, 1998 and 1997 respectively.

The Company also maintains stock option and stock apprecia-

tion right plans at its Kaplan subsidiary that provide for the issuance

of stock options representing 10 percent of Kaplan, Inc. stock and the

issuance of stock appreciation rights to certain members of Kaplan’s

management. These options and appreciation rights vest ratably over

five years from issuance. For 1999 and 1998, the Company recorded

expense of $7,200,000 and $6,000,000 related to these plans.

Average Number of Shares Outstanding. Basic earnings per share are

based on the weighted average number of shares of common stock

outstanding during each year. Diluted earnings per common share

are based upon the weighted average number of shares of common

stock outstanding each year, adjusted for the dilutive effect of shares

48 THE WASHINGTON POST COMPANY