Washington Post 1999 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 1999 Washington Post annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

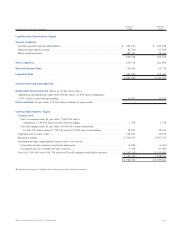

Contributions to multi-employer pension plans, which are

generally based on hours worked, amounted to $2,300,000 in 1999

and 1998, and $2,000,000 in 1997.

The Company recorded expense associated with retirement

benefits provided under incentive savings plans (primarily 401k

plans) of approximately $13,300,000 in 1999 and 1998, and

$12,400,000 in 1997.

J. LEASE AND OTHER COMMITMENTS

The Company leases real property under operating agreements.

Many of the leases contain renewal options and escalation clauses

that require payments of additional rent to the extent of increases

in the related operating costs.

At January 2, 2000, future minimum rental payments under non-

cancelable operating leases approximate the following (in thousands):

2000 ...........................................................$31,300

2001 ............................................................ 26,600

2002 ............................................................ 23,000

2003 ........................................................... 19,100

2004 ........................................................... 16,500

Thereafter ....................................................... 50,600

$ 167,100

Minimum payments have not been reduced by minimum sublease

rentals of $1,900,000 due in the future under noncancelable subleases.

Rent expense under operating leases included in operating costs

and expenses was approximately $33,600,000, $31,800,000 and

$27,800,000 in 1999, 1998 and 1997, respectively. Sublease

income was approximately $433,000, $500,000 and $400,000 in

1999, 1998 and 1997, respectively.

The Company’s broadcast subsidiaries are parties to certain agree-

ments that commit them to purchase programming to be produced in

future years. At January 2, 2000, such commitments amounted to

approximately $47,000,000. If such programs are not produced, the

Company’s commitment would expire without obligation.

K. ACQUI SITIONS, EXCHANGES AND DISPOSITIONS

Acquisitions. The Company completed acquisitions totaling approxi-

mately $90,500,000 in 1999, $320,600,000 in 1998 and

$118,900,000 in 1997. All of these acquisitions were accounted for

using the purchase method and, accordingly, the assets and liabili-

ties of the companies acquired have been recorded at their estimated

fair values at the date of acquisition.

During 1999, the Company acquired cable systems serving

10,300 subscribers in North Dakota, Oklahoma and Arizona (April

and August 1999 for $18,300,000); two Certified Financial Analyst

test preparation companies (November and December 1999 for

$16,000,000) and a travel guide magazine (in December 1999 for

$10,200,000). In addition, the Company acquired various other

smaller businesses throughout 1999 for $46,000,000 (principally

consisting of educational services companies).

Acquisitions in 1998 included an educational services company

that provides English language study programs (in January 1998

for $16,100,000); a 36,000 subscriber cable system serving

Anniston, Alabama (in June 1998 for $66,500,000); cable systems

serving 72,000 subscribers in Mississippi, Louisiana, Texas and

Oklahoma (in July 1998 for $130,100,000); and a publisher and

provider of licensing training for securities, insurance and real

estate professionals (in July 1998 for $35,200,000). In addition,

the Company acquired various other smaller businesses throughout

1998 for $72,700,000 (principally consisting of educational and

career service companies and small cable systems).

In 1997, the Company acquired cable systems serving approxi-

mately 16,000 subscribers in Cleveland, Mississippi (in February

1997 for $23,900,000), the publishing rights to two computer serv-

ice industry trade periodicals and the rights to conduct two computer

industry trade shows (in December 1997 for $84,500,000), and

various other smaller businesses throughout 1997 for $10,500,000.

The results of operations for each of the businesses acquired are

included in the Consolidated Statements of Income from their respective

dates of acquisition. Pro forma results of operations for 1999, 1998

and 1997, assuming the acquisitions occurred at the beginning of 1997,

are not materially different from reported results of operations.

Exchanges. In June 1997, the Company exchanged the assets of

certain cable systems with Tele-Communications, Inc. This trade

resulted in an increase of about 21,000 subscribers for the Company.

In September 1997, the Company completed a transaction

with Meredith Corporation whereby the Company exchanged the

assets of WFSB-TV, the CBS affiliate in Hartford, Connecticut,

and approximately $60,000,000 for the assets of WCPX-TV, the

CBS affiliate in Orlando, Florida.

The assets obtained in these transactions were recorded at

the carrying value of the assets exchanged plus cash consideration.

No gain or loss resulted from these exchange transactions.

50 THE WASHINGTON POST COMPANY