Vodafone 1997 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 1997 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report & Accounts for the year ended 31 March 1997

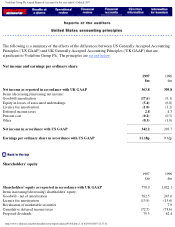

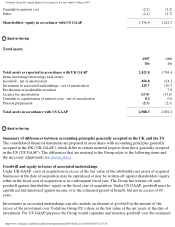

period of benefit. The Group's equity in earnings of the associated undertakings is reduced by the

amortisation of such goodwill.

Marketable securities

Under UK GAAP, quoted investments held as fixed asset investments are carried at cost. Under US

GAAP, they are classified as available-for-sale securities and are valued at market price with unrealised

gains and losses excluded from earnings and reported within a separate component of shareholders' equity.

Licence fee amortisation

Under UK GAAP, licence fees are amortised in proportion to the expected usage of the network during

the start up period and then on a straight line basis. Under US GAAP, licence fees are amortised on a

straight line basis from the date of acquisition.

Deferred taxation

Under UK GAAP, deferred taxation is provided at the rates at which the taxation is expected to become

payable. No provision is made for amounts which are not expected to become payable in the foreseeable

future.

Under US GAAP, deferred taxation is provided on all temporary differences under the liability method at

rates at which the taxation would be payable in the relevant future year.

Capitalisation of interest costs

Under UK GAAP, interest on borrowings used to finance the construction of an asset is not required to be

included in the cost of the asset. Under US GAAP, the interest cost on borrowings used to finance the

construction of an asset is capitalised during the period of construction until the date that the asset is

placed in service. Such interest cost is amortised over the estimated useful life of the related asset.

Pension costs

Under both UK GAAP and US GAAP pension costs are provided so as to provide for future pension

liabilities. However, there are differences in the prescribed methods of valuation which give rise to GAAP

adjustments to the pension cost and the pension prepayment.

Proposed dividends

Under UK GAAP, dividends are included in the financial statements when recommended by the Board of

directors to the shareholders. Under US GAAP, dividends are not included in the financial statements

until declared by the Board of directors.

http://www.vodafone.com/download/investor/reports/annual97/4/8.htm (3 of 4)29/03/2007 22:37:32