Vodafone 1997 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 1997 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report & Accounts for the year ended 31 March 1997

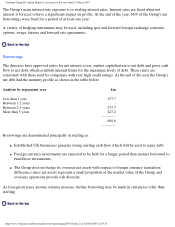

The Group's main interest rate exposure is to sterling interest rates. Interest rates are fixed when net

interest is forecast to have a significant impact on profits. At the end of the year, 66% of the Group's net

borrowings were fixed for a period of at least one year.

A variety of hedging instruments may be used, including spot and forward foreign exchange contracts,

options, swaps, futures and forward rate agreements.

Borrowings

The directors have approved ratios for net interest cover, market capitalisation to net debt and gross cash

flow to net debt, which establish internal limits for the maximum levels of debt. These ratios are

consistent with those used by companies with very high credit ratings. At the end of the year the Group's

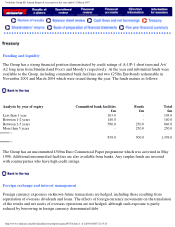

net debt had the maturity profile as shown in the table below.

Analysis by repayment year £m

Less than 1 year 157.7

Between 1-2 years -

Between 2-5 years 275.7

More than 5 years 247.2

680.6

Borrowings are denominated principally in sterling as:

● Established UK businesses generate strong sterling cash flow which will be used to repay debt;

● Foreign currency investments are expected to be held for a longer period than monies borrowed to

fund those investments;

● The Group does not hedge its overseas net assets with respect to foreign currency translation

differences since net assets represent a small proportion of the market value of the Group and

overseas operations provide risk diversity.

As foreign currency income streams increase, further borrowing may be made in currencies other than

sterling.

http://www.vodafone.com/download/investor/reports/annual97/3/4.htm (2 of 2)29/03/2007 22:35:23