Vodafone 1997 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 1997 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report & Accounts for the year ended 31 March 1997

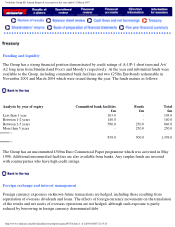

Net cash flow generated from operating activities was £644.3m and was used mainly to fund capital

expenditure of £351.2m, to enhance and expand the digital networks in the UK and Australia, pay tax of

£150.1m and finance dividends of £130.0m. New investments of £528.0m, which comprise equity and

shareholder loans and the external debt of subsidiaries acquired, were financed principally by debt and as

a result net borrowings increased by £473.1m to £680.6m. An analysis of new investments is set out in the

table below. These figures exclude consideration of £133.1m payable after 31 March 1997.

New investments £m

SFR 240.4

Panafon/Panavox 96.7

Talkland 65.5

Peoples Phone 55.0

Others 70.4

528.0

Future investments

The Group expects to spend approximately £500m on capital expenditure in 1997/98. About half of this

expenditure will be in the UK, where capacity is being added to the digital network to accommodate

subscriber growth and traffic generated by visitors. The balance will be expended on the digital networks

in Australia and Greece to enhance capacity and improve quality of service. Investment expenditure will

be in the order of £170m, assuming the Group exercises its option to acquire a further 3.89% in SFR. This

could be higher if suitable opportunities arise.

http://www.vodafone.com/download/investor/reports/annual97/3/3.htm29/03/2007 22:33:10