Vodafone 1997 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 1997 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report & Accounts for the year ended 31 March 1997

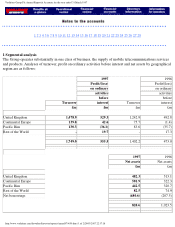

Turnover

Turnover represents the invoiced value, excluding value added tax, of services and goods supplied by the

Group.

Pensions

Costs relating to defined benefit plans which are periodically calculated by professionally qualified

actuaries, are charged against profits so that the expected costs of providing pensions are recognised

during the period in which benefit is derived from the employees' services.

The costs of the various pension schemes may vary from the funding, dependent upon actuarial advice,

with any difference between pension cost and funding being treated as a provision or prepayment.

Defined contribution pension costs charged to the profit and loss account represent contributions payable

in respect of the period.

Research and development

Expenditure on research and development is written-off in the year in which it is incurred.

Scrip dividends

Dividends satisfied by the issue of ordinary shares have been credited to reserves. The nominal value of

the shares issued has been offset against the share premium account.

Intangible fixed assets

Purchased intangible fixed assets, including licence fees, are capitalised at cost except for subscriber

contracts, which are written-off to reserves in the year in which they are acquired.

Network licence costs are amortised over the periods of the licences. Amortisation is charged from

commencement of service of the network. The annual charge is calculated in proportion to the expected

usage of the network during the start up period and on a straight line basis thereafter.

Tangible fixed assets

Tangible fixed assets are stated at cost less accumulated depreciation.

Depreciation is not provided on freehold land. The cost of other tangible fixed assets is written-off, from

the time they are brought into use, by equal instalments over their expected useful lives as follows:

http://www.vodafone.com/download/investor/reports/annual97/4/9.htm (2 of 4)29/03/2007 22:37:11