Vodafone 1997 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 1997 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report & Accounts for the year ended 31 March 1997

Basis of accounting

The financial statements have been prepared in accordance with applicable accounting standards. The

particular accounting policies adopted are described below.

The financial statements comply with two new accounting standards issued by the Accounting Standard

Board : FRS 1 (Revised) - 'Cash Flow Statements' and FRS 8 - 'Related Party Disclosures'. The

implementation of FRS 1 (Revised) has necessitated the restatement of comparative data.

Accounting convention

The financial statements are prepared under the historical cost convention.

Basis of consolidation

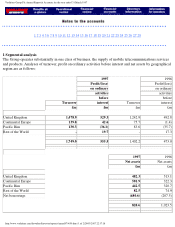

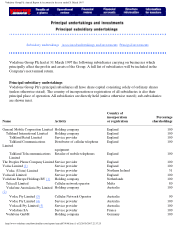

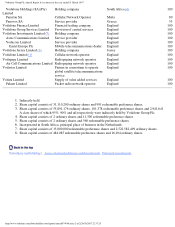

The Group financial statements consolidate the financial statements of the Company and its subsidiaries

and include the Group's share of results of associated undertakings for financial statements made up to 31

March 1997.

Goodwill

The surplus of cost over fair value attributed to the net assets (excluding goodwill) of subsidiary or

associated undertakings acquired during the year is written-off directly to reserves.

Foreign currencies

Transactions in foreign currencies are recorded at the exchange rates ruling on the dates of those

transactions, adjusted for the effects of any hedging arrangements. Foreign currency monetary assets and

liabilities, including the Group's interest in the underlying net assets of associates, are translated into

sterling at year end rates.

The results of the overseas subsidiary and associated undertakings are translated into sterling at average

rates of exchange. The adjustment to year end rates is taken to reserves. Exchange differences which arise

on the retranslation of overseas subsidiary and associated undertakings' balance sheets at the beginning of

the year and equity additions and withdrawals during the financial year are dealt with as a movement in

reserves.

Other translation differences are dealt with in the profit and loss account.

http://www.vodafone.com/download/investor/reports/annual97/4/9.htm (1 of 4)29/03/2007 22:37:11