United Healthcare 2002 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2002 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

{ 35 }

UnitedHealth Group

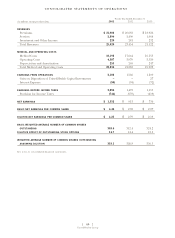

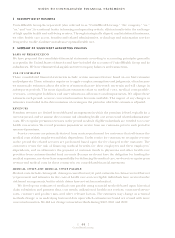

MEDICAL COSTS

A substantial portion of our medical costs payable is based on estimates, which include estimates for the

costs of health care services eligible individuals have received under risk-based arrangements but for

which claims have not yet been submitted, and estimates for the costs of claims we have received but have

not yet processed. We develop medical costs payable estimates using consistently applied actuarial

methods based on historical claim submission and payment data, cost trends, utilization of health care

services, contracted service rates, customer and product mix, and other relevant factors.

Over time, as actual claim costs and more current information become available, our estimated liability

for medical costs payable develops either favorably, with revised payable estimates less than originally

reported medical costs payable, or unfavorably, with revised payable estimates more than originally reported

medical costs payable. We include the impacts of changes in estimates in the operating results of the period

in which we identify the changes.

Each period, our operating results include the effects of revisions in estimates related to all prior

periods, based on actual claims processed and paid. Changes in estimates may relate to the prior fiscal

year or to prior quarterly reporting periods within the same fiscal year. Changes in estimates for prior

quarterly reporting periods within the same fiscal year have no impact on total medical costs reported for

that fiscal year. In contrast, changes in medical costs payable estimates for prior fiscal years that are

identified in the current year affect total medical costs reported for the current fiscal year.

Our medical costs payable estimates as of December 31, 2001, 2000 and 1999 each developed favorably

in the subsequent fiscal year by approximately $70 million, $30 million and $15 million, respectively,

representing earnings from operations of 3.2% in 2002, 1.9% in 2001 and 1.3% in 2000. Favorable

development of prior year medical costs payable estimates represented 0.5%, 0.2%, and 0.1% of medical

costs in 2002, 2001 and 2000, respectively, and 2.7%, 1.2%, and 0.7% of medical costs payable as of

December 31, 2001, 2000, and 1999, respectively. Management does not believe the changes in medical

costs payable estimates described above were significant in relation to earnings from operations,

medical costs or medical costs payable. Amounts related to the AARP business were excluded from these

calculations since the underwriting gains and losses associated with this business are recorded as an

increase or decrease to a rate stabilization fund. For additional information regarding the components

of the change in medical costs payable for the years ended December 31, 2002, 2001 and 2000, see

Note 7 of the consolidated financial statements.

Our estimate of medical costs payable represents management’s best estimate of the company’s liability

for unpaid medical costs as of December 31, 2002, developed using consistently applied actuarial methods.

Management believes the amount of medical costs payable is reasonable and adequate to cover the

company’s liability for unpaid claims as of December 31, 2002; however, actual claim payments may differ

from established estimates. Assuming a hypothetical 1% difference between our December 31, 2002

estimates of medical costs payable and actual costs payable, excluding the AARP business, 2002 earnings

from operations would increase or decrease by approximately $28 million and basic and diluted net

earnings per common share would increase or decrease by approximately $0.06 per share.