United Healthcare 2002 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2002 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

{ 27 }

UnitedHealth Group

2001 RESULTS COMPARED TO 2000 RESULTS

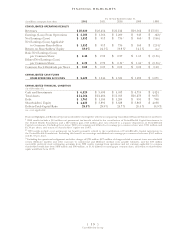

CONSOLIDATED FINANCIAL RESULTS

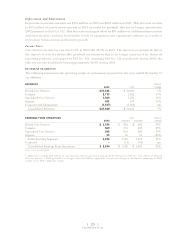

Revenues

Consolidated revenues increased by 11% in 2001 to $23.5 billion. Strong and balanced growth across all

business segments was partially offset by the impact of planned exits in 2000 from UnitedHealthcare’s

commercial businesses in the Pacific Coast region, the withdrawal of its Medicare+Choice product

offering from targeted counties and the closure of Uniprise’s Medicare fiscal intermediary operations.

Following is a discussion of 2001 consolidated revenue trends for each revenue component.

Premium Revenues Consolidated premium revenues in 2001 totaled $20.7 billion, an increase of $1.8 billion,

or 9%, compared with 2000. This increase was primarily driven by average net premium rate increases in

excess of 13% on UnitedHealthcare’s renewing commercial risk-based business, partially offset by the impact

of business and market exits.

Service Revenues Service revenues in 2001 totaled $2.5 billion, an increase of $526 million, or 27%, over

2000. The overall increase in service revenues was primarily the result of 20% growth in Uniprise’s customer

base, growth in UnitedHealthcare’s fee-based business, and establishment of the Ovations Pharmacy

Services business in June 2001.

Investment and Other Income Investment and other income in 2001 totaled $281 million, an increase

of $49 million over 2000. Lower interest yields on investments in 2001 compared with 2000 were substantially

offset by the impact of increased levels of cash and fixed-income investments in 2001. Net realized capital

gains in 2001 were $11 million, compared to net realized capital losses of $34 million in 2000.

Medical Costs

The consolidated medical care ratio decreased from 85.4% in 2000 to 85.3% in 2001. Excluding the

AARP business, the medical care ratio was 83.9% in both 2000 and 2001, as net premium rate increases

were generally well matched with increases in medical benefit costs.

On an absolute dollar basis, medical costs increased $1.5 billion, or 9%, over 2000. The increase was

driven by medical cost inflation, increased health care consumption patterns, benefit changes and

product mix changes.