United Healthcare 2002 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2002 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

{ 24 }

UnitedHealth Group

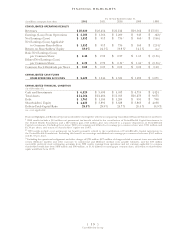

Health Care Services

The Health Care Services segment consists of the UnitedHealthcare, Ovations and AmeriChoice businesses.

UnitedHealthcare coordinates network-based health and well-being services on behalf of local employers and

consumers. Ovations delivers health and well-being services for Americans age 50 and older. AmeriChoice

facilitates and manages health care services for state Medicaid programs and their beneficiaries.

Health Care Services posted record revenues of $21.6 billion in 2002, an increase of approximately

$1.2 billion, or 6%, over 2001. The increase in revenues primarily resulted from an increase of

approximately $1.2 billion in UnitedHealthcare’s commercial premium revenues. This was driven by

average net premium rate increases in excess of 13% on renewing commercial risk-based business,

partially offset by the effects of targeted withdrawals from unprofitable risk-based arrangements with

commercial customers using multiple health benefit carriers. Premium revenues from Medicaid

programs increased by $450 million in 2002, of which $240 million related to the acquisition of

AmeriChoice on September 30, 2002. Offsetting these increases, Medicare+Choice premium revenues

decreased by $850 million as a result of planned withdrawals and benefit design changes in certain

markets in response to insufficient Medicare program reimbursement rates. The balance of Health Care

Services’ revenue growth in 2002 includes a $240 million increase in Ovations’ revenues driven by an

increase in individuals served by both its Medicare supplement products provided to AARP members and

its Evercare business, and a $140 million increase in revenues from its Pharmacy Services business,

established in June 2001.

Health Care Services realized earnings from operations of $1.3 billion in 2002, an increase of

$392 million, or 42%, over 2001 on a reported basis, and an increase of $354 million, or 36%, over 2001

on a FAS No. 142 comparable reporting basis. This increase primarily resulted from improved gross

margins on UnitedHealthcare’s commercial risk-based products, revenue growth and operating cost

efficiencies derived from process improvements, technology deployment and cost management initiatives,

principally in the form of reduced labor and occupancy costs supporting transaction processing and

customer service, billing and enrollment functions. Health Care Services’ operating margin increased to

6.2% in 2002 from 4.6% on a reported basis and from 4.8% on a FAS No. 142 comparable reporting basis

in 2001. This increase was driven by a combination of an improved medical care ratio, productivity

improvements and a shift in product mix from risk-based products to higher-margin, fee-based products.

UnitedHealthcare’s commercial medical care ratio decreased by 230 basis points from 84.1% in 2001

to 81.8% in 2002. Approximately 130 basis points of the commercial medical care ratio decrease resulted

from targeted withdrawals from unprofitable risk-based arrangements with commercial customers using

multiple carriers and a shift in commercial customer mix, with a larger percentage of premium revenues

derived from small business customers. These employer groups typically have a lower medical care ratio,

but carry higher operating costs than larger customers. The balance of the decrease in the commercial

medical care ratio was primarily driven by changes in product mix, care management activities and net

premium rate increases that exceeded overall medical benefit cost increases.