United Healthcare 2002 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2002 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

{ 32 }

UnitedHealth Group

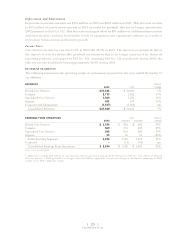

We have credit arrangements for $900 million that support our commercial paper program. These

credit arrangements include a $450 million revolving facility that expires in July 2005, and a $450 million,

364-day facility that expires in July 2003. We also have the capacity to issue approximately $200 million

of extendible commercial notes (ECNs). As of December 31, 2002 and 2001, we had no amounts

outstanding under our credit facilities or ECNs.

Our debt arrangements and credit facilities contain various covenants, the most restrictive of which

require us to maintain a debt-to-total-capital ratio below 45% and to exceed specified minimum interest

coverage levels. We are in compliance with the requirements of all debt covenants.

Our senior debt is rated “A” by Standard & Poor’s (S&P) and Fitch, and “A3” by Moody’s. Our

commercial paper and ECN programs are rated “A-1” by S&P, “F-1” by Fitch, and “P-2” by Moody’s.

Consistent with our intention of maintaining our senior debt ratings in the “A” range, we intend to maintain

our debt-to-total-capital ratio at 30% or less. A significant downgrade in our debt and commercial paper

ratings would likely adversely affect our borrowing capacity and costs.

The remaining issuing capacity of all securities covered by our S-3 shelf registration statement (for

common stock, preferred stock, debt securities and other securities) is $450 million. We may publicly offer

such securities from time to time at prices and terms to be determined at the time of offering. We also have an

S-4 acquisition shelf registration statement under which we have remaining issuing capacity of approximately

5.6 million shares of our common stock in connection with acquisition activities.

During 2002 and 2001, we invested $419 million and $425 million, respectively, in property, equipment,

capitalized software and information technology hardware. These investments were made to support

business growth, operational and cost efficiencies, service improvements and technology enhancements.

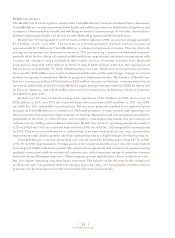

Effective September 30, 2002, we acquired AmeriChoice Corporation (AmeriChoice), a leading

organization engaged in facilitating health care benefits and services for Medicaid beneficiaries in the

states of New York, New Jersey and Pennsylvania. We are integrating our existing Medicaid business with

AmeriChoice, creating efficiencies from the consolidation of health care provider networks, technology

platforms and operations. We issued 5.3 million shares of our common stock with a fair value of

approximately $480 million in exchange for 93.5% of the outstanding AmeriChoice common stock. We

issued vested stock options with a fair value of approximately $15 million in exchange for outstanding

stock options held by AmeriChoice employees, and we paid cash of approximately $82 million, mainly to

pay off existing AmeriChoice debt. We will acquire the remaining minority interest after five years at a value

based on a multiple of the earnings of the combined Medicaid business. We have the option to acquire the

minority interest at an earlier date if specific events occur, such as the termination or resignation of key

AmeriChoice employees.