United Healthcare 2001 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2001 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PAGE 47 UnitedHealth Group

[4]OPERATIONAL REALIGNMENT AND OTHER CHARGES

In conjunction with a comprehensive operational realignment initiated in 1998, we developed and

approved an implementation plan (the Plan). We recognized corresponding charges to operations of

$725 million in the second quarter of 1998, which reflected the estimated costs to be incurred under the Plan.

The charges included costs associated with asset impairments; employee terminations; disposing of or

discontinuing business units, product lines and contracts; and consolidating and eliminating certain claim

processing and customer service operations and associated real estate obligations.

We completed our operational realignment plan in 2001. Actual costs incurred executing the Plan

exceeded estimates by approximately $4 million, which has been included in 2001 operating costs in the

Consolidated Statements of Operations. These excess costs were incurred in the fourth quarter of 2001.

Activities associated with the Plan resulted in the reduction of approximately 5,100 positions, affecting

approximately 5,800 people.

As of December 31, 2000, we had completed all planned business dispositions and market exits pursuant to

the Plan. Accordingly, our 2001 financial statements do not include the operating results of exited businesses or

markets. Our Consolidated Statements of Operations include results for businesses disposed of and markets

exited in connection with our operational realignment as follows: $312 million in revenues and $9 million in

earnings from operations in 2000, and $689 million in revenues and $41 million of losses from operations in

1999. These amounts do not include operating results from the counties where UnitedHealthcare withdrew its

Medicare product offerings effective January 1, 2001, and January 1, 2000. Annual revenues for 2000 from the

counties exited effective January 1, 2001, were approximately $320 million. Annual revenues for 1999 from the

counties exited effective January 1, 2000, were approximately $230 million.

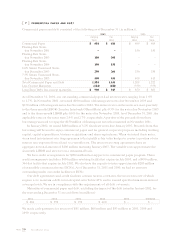

The operational realignment and other charges did not cover certain aspects of the Plan, including

new information systems, data conversions, process re-engineering, temporary duplicate staffing costs as

we consolidated processing and service centers, and employee relocation and training. These costs were

expensed as incurred or capitalized, as appropriate. During 2001, 2000 and 1999, we incurred expenses

of approximately $20 million, $57 million and $52 million, respectively, related to these activities.

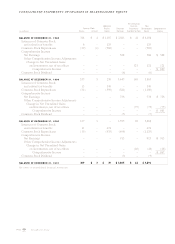

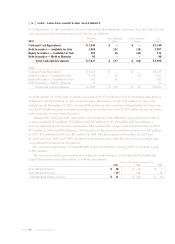

The table below is a roll-forward of accrued operational realignment and other charges, which are included

in Accounts Payable and Accrued Liabilities in the accompanying Consolidated Balance Sheets (in millions):

Severance and Noncancelable Disposition of

Asset Outplacement Lease Businesses and

Impairments Costs Obligations Other Costs Total

Balance at December 31, 1997 $–$–$–$–$–

Provision for Operational Realignment

and Other Charges 430 142 82 71 725

Additional Charges (Credits) 21 (20) (9) 8 –

Cash Payments – (19) (6) (13) (38)

Noncash Charges (451) – – – (451)

Balance at December 31, 1998 – 103 67 66 236

Additional Charges (Credits) – (22) 13 9 –

Cash Payments – (46) (18) (45) (109)

Balance at December 31, 1999 – 35 62 30 127

Cash Payments – (24) (20) (18) (62)

Balance at December 31, 2000 – 11 42 12 65

Additional Charges (Credits) – 10 – (6) 4

Cash Payments – (21) (11) (6) (38)

Noncash Charges

1

– – (31) – (31)

Balance at December 31, 2001 $ – $ – $ – $ – $ –

1Consists of noncancelable lease obligations for which definitive subleases have been finalized. These amounts have been trans-

ferred to other liability accounts as they are fixed and determinable obligations.