United Healthcare 2001 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2001 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PAGE 44 UnitedHealth Group

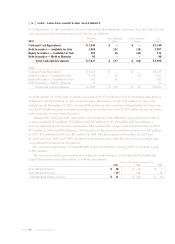

GOODWILL AND OTHER INTANGIBLE ASSETS

Goodwill represents the amount by which the purchase price and transaction costs of businesses we

have acquired exceeds the estimated fair value of the net tangible assets and identifiable intangible

assets of these businesses. Goodwill and other intangible assets are amortized on a straight-line basis

over useful lives ranging from three years to 40 years, with a weighted-average useful life of 32 years at

December 31, 2001.

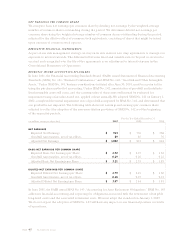

The two most significant components of goodwill and other intangible assets are: 1) goodwill of

$2.2 billion at December 31, 2001, and $2.1 billion at December 31, 2000, net of accumulated amortization;

and 2) employer group contracts, supporting infrastructure, distribution networks and institutional

knowledge of $512 million at December 31, 2001, and $530 million at December 31, 2000, net of

accumulated amortization.

LONG-LIVED ASSETS

We review long-lived assets, including goodwill and other intangible assets, and property, equipment

and capitalized software, for events or changes in circumstances that would indicate we might not

recover their carrying value. We consider many factors, including estimated future cash flows associated

with the assets, to make this decision. We record assets held for sale at the lower of their carrying

amount or fair value, less any costs for the final settlement.

OTHER POLICY LIABILITIES

Other policy liabilities include the rate stabilization fund associated with the AARP program (see Note 5)

and customer balances related to experience-rated insurance products.

Customer balances represent premium payments we have received that exceed what customers owe

based on actual claim experience, and deposit accounts that have accumulated under experience-rated

contracts. At the customer’s option, these balances may be refunded or used to pay future premiums or

claims under eligible contracts.

INCOME TAXES

Deferred income tax assets and liabilities are recognized for the differences between the financial and

income tax reporting bases of assets and liabilities based on enacted tax rates and laws. The deferred

income tax provision or benefit generally reflects the net change in deferred income tax assets and

liabilities during the year. The current income tax provision reflects the tax consequences of revenues

and expenses currently taxable or deductible on various income tax returns for the year reported.

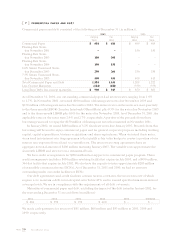

STOCK-BASED COMPENSATION

We do not recognize compensation expense in connection with employee stock option grants because

we grant stock options at exercise prices that equal or exceed the fair market value of the stock on the

date the options are granted. Information on what our stock-based compensation expenses would have

been had we calculated those expenses using the fair market values of outstanding stock options is

included in Note 9.