TomTom 2012 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2012 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

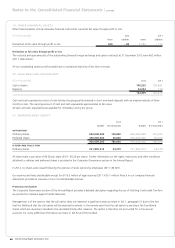

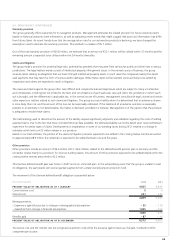

17. TRADE RECEIVABLES (CONTINUED)

The group’s exposure to credit risk is infl uenced mainly by the individual characteristics of each customer. There is some concentration of

credit risk with certain of our large customers’ accounts. Management actively monitors the credit risk related to these customers and takes

pro-active action to reduce credit limits if required. In our Consumer business, credit risk is to some extent further mitigated by the purchase

of insurance, however it is not possible to insure all open credit exposures. Automotive, Licensing and Business Solutions customers are not

insured for credit risk.

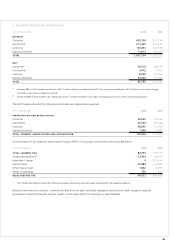

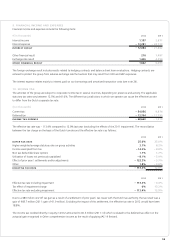

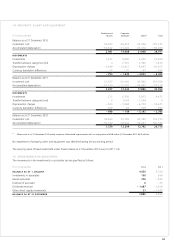

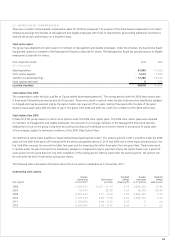

The following summarises the movement in the allowance for doubtful trade receivables account:

(€ in thousands) 2012 2011

Balance as at 1 January – 1,814 – 3,360

Additional receivables impairment – 1,856 – 2,597

Receivables written-off during the year as uncollectible 1,163 2,166

Unused amounts reversed 635 2,025

Currency translation differences 9– 48

BALANCE AS AT 31 DECEMBER – 1,863 – 1,814

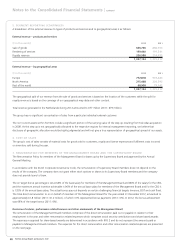

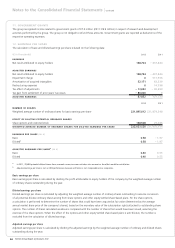

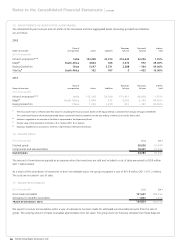

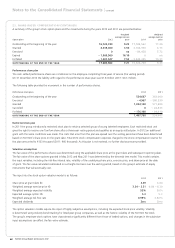

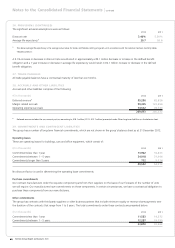

The following table sets out details of the age of trade accounts receivable that are not overdue, as the payment terms specifi ed in the

terms and conditions established with our customers have not been exceeded, and an analysis of overdue amounts and related provisions

for doubtful trade accounts receivable:

(€ in thousands) 2012 2011

Of which:

Not overdue 117,574 168,060

Overdue < 3 months 32,583 17,617

3 to 6 months 299 999

Over 6 months 1,241 77

Less provision – 1,863 – 1,814

TRADE RECEIVABLES (NET) 149,834 184,939

The provisions recorded in 2012 and 2011 are mainly related to the overdue amounts.

Trade accounts receivable include amounts denominated in the following major currencies:

(€ in thousands) 2012 2011

EUR 60,464 81,228

GBP 19,490 16,618

USD 53,772 70,072

Other 16,108 17,021

TRADE RECEIVABLES (NET) 149,834 184,939

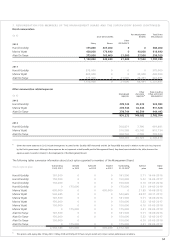

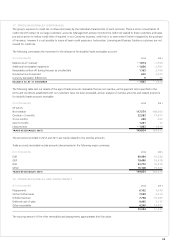

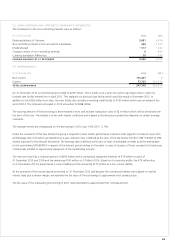

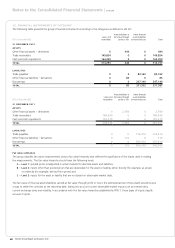

18. OTHER RECEIVABLES AND PREPAYMENTS

(€ in thousands) 2012 2011

Prepayments 6,102 7,545

VAT and other taxes 7,599 6,410

Unbilled revenue 7,758 19,689

Deferred cost of sales 9,495 3,175

Other receivables 4,340 14,423

35,294 51,242

The carrying amount of the other receivables and prepayments approximates their fair value.