TomTom 2012 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2012 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

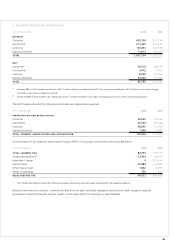

13. INTANGIBLE ASSETS

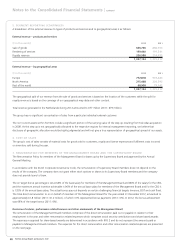

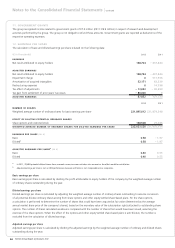

(€ in thousands) 2012 2011

Goodwill 381,569 381,569

Other intangible assets 821,233 871,528

TOTAL INTANGIBLE ASSETS 1,202,802 1,253,097

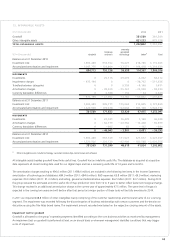

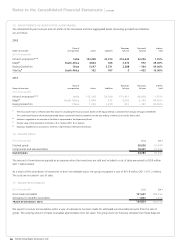

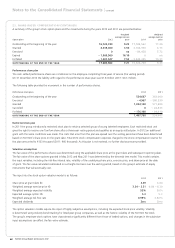

(€ in thousands) Goodwill

Database

and tools

Internally

generated

technology Other1Total

Balance as at 31 December 2010

Investment cost 1,902,489 918,102 76,229 218,785 3,115,605

Accumulated amortisation and impairment – 1,047,776 – 124,864 – 37,571 – 104,418 – 1,314,629

854,713 793,238 38,658 114,367 1,800,976

MOVEMENTS

Investments 0 25,116 29,274 4,022 58,412

Impairment charges – 473,144 0 0 – 38,792 – 511,936

Transfers between categories 0 0 9,759 – 8,148 1,611

Amortisation charges 0 – 49,509 – 25,161 – 23,920 – 98,590

Currency translation differences 0 2,788 – 110 – 54 2,624

– 473,144 – 21,605 13,762 – 66,892 – 547,879

Balance as at 31 December 2011

Investment cost 1,902,489 945,711 115,064 214,605 3,177,869

Accumulated amortisation and impairment – 1,520,920 – 174,078 – 62,644 – 167,130 – 1,924,772

381,569 771,633 52,420 47,475 1,253,097

MOVEMENTS

Investments 0 22,741 16,478 7,169 46,388

Amortisation charges 0 – 62,179 – 20,362 – 13,458 – 95,999

Currency translation differences 0 – 605 83 – 162 – 684

0 – 40,043 – 3,801 – 6,451 – 50,295

Balance as at 31 December 2012

Investment cost 1,902,489 967,729 131,527 221,612 3,223,357

Accumulated amortisation and impairment – 1,520,920 – 236,139 – 82,908 – 180,588 – 2,020,555

381,569 731,590 48,619 41,024 1,202,802

1 Other intangible assets include technology, customer relationships, brand name and software.

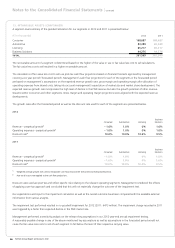

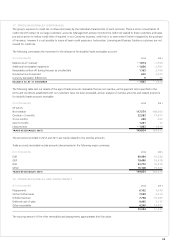

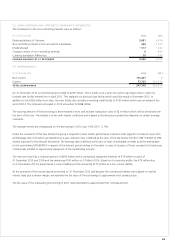

All intangible assets besides goodwill have fi nite useful lives. Goodwill has an indefi nite useful life. The database as acquired at acquisition

date represents all stored routing data used for our digital maps and has a remaining useful life of 14 years and 5 months.

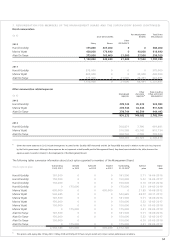

The amortisation charges totalling to €96,0 million (2011: €98.6 million) are included in the following line items in the Income Statement:

amortisation of technology and databases: €84.0 million (2011: €84.6 million); R&D expenses: €5.8 million (2011: €9.0 million); marketing

expenses: €0.0 million (2011: €1.3 million) and selling, general and administrative expenses: €6.2 million (2011: €3.7 million). During 2012

the group reduced the estimated economic useful life of map production tools from 10 to 5 years to better refl ect faster technological change.

This change resulted in an additional amortisation charge in the current year of approximately €7.5 million. The same level of impact is

expected in the coming two years and will decline after that period as a major portion of these tools will be fully amortised in 2014.

In 2011 we impaired €38.8 million of other intangibles mainly comprising of the customer relationships and the brand name of our Licensing

segment. The impairment was recorded following the discontinuation of business relationships with certain customers and the decision to

discontinue using the Tele Atlas brand name. The impairment amount recorded was based on the respective carrying amount of the assets.

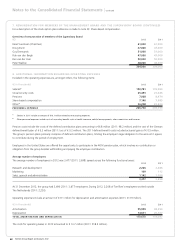

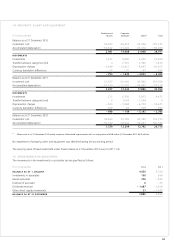

Impairment test for goodwill

Goodwill is allocated to the group’s operating segments identifi ed according to the core business activities as monitored by management.

An impairment test on goodwill is performed at least on an annual basis or whenever management identifi es conditions that may trigger

a risk of impairment.