TomTom 2012 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2012 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TomTom Annual Report and Accounts 2012

46

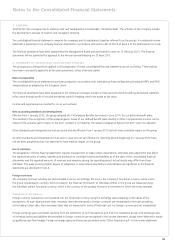

Notes to the Consolidated Financial Statements | continued

3. FINANCIAL RISK MANAGEMENT (CONTINUED)

Our exposure to wholesale customers is managed through establishing proper credit limits, continuous credit risk assessments for each

individual customer and the purchase of credit insurance to cover a large part of our exposure within our Consumer business.

Our procedures include aligning our credit and trading terms and conditions with our assessment of the individual characteristics and risk

profi le of each customer. This assessment is made based on our past experiences and independent ratings from external rating agencies

whenever available.

As of 31 December 2012, our total bad debt provision represented approximately 0.2% of our group revenue (2011: 0.1%).

Foreign currencies

We operate internationally and conduct our business in multiple currencies. Revenues are earned in euro, pound sterling, the US dollar and

other currencies, and do not necessarily match our cost of sales and other costs which are largely in euro and the US dollar and to a certain

extent in other currencies. Foreign currency exposures on our commercial transactions relate mainly to our estimated purchases and sales

transactions that are denominated in currencies other than our reporting currency – the euro (€).

We manage our foreign currency transaction risk through the buying and selling of options to cover forecasted net exposures and by

entering into forward contracts for near term forecasts and commitments. We aim to cover our exposure for both purchases and sales for

the relevant term based on our business characteristics. All such transactions are carried out within the guidelines set by the Treasury Policy.

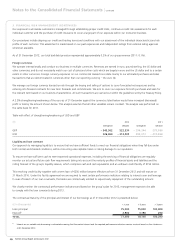

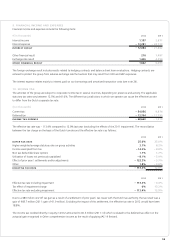

A 2.5% strengthening/weakening of the euro as of 31 December against the currencies listed below would have increased (decreased)

profi t or loss by the amount shown below. This analysis assumes that all other variables remain constant. The analysis was performed on

the same basis for 2011.

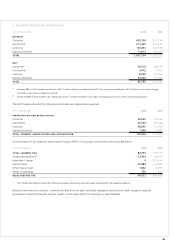

Table with effect of strengthening/weakening of USD and GBP

(€) 2012 2011

Strengthen Weaken Strengthen Weaken

GBP – 545,362 522,534 – 294,344 279,986

USD 326,060 – 312,405 499,013 – 474,068

Liquidity and loan covenant

Our approach to managing liquidity is to ensure that we have suffi cient funds to meet our fi nancial obligations when they fall due under

both normal and stressed conditions, without incurring unacceptable losses or risking damage to our reputation.

To ensure we have suffi cient cash to meet expected operational expenses, including the servicing of fi nancial obligations we regularly

monitor our actual and future cash fl ow requirements taking into account the maturity profi les of fi nancial assets and liabilities and the

rolling forecast of the group’s liquidity reserve, which comprises cash and cash equivalents and an undrawn credit facility of €150 million.

This revolving credit facility together with a term loan of €250 million became effective as from 31 December 2012 and will mature on

31 March 2016. Under this facility agreement we are required to meet certain performance indicators relating to interest cover and leverage.

In case of breach of our loan covenants, the banks are contractually entitled to request early repayment of the outstanding amount.

We closely monitor the contractual performance indicators and based on the group’s plan for 2013, management expects to be able

to comply with the loan covenants during 2013.

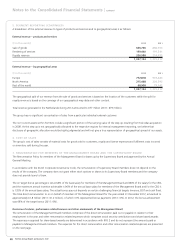

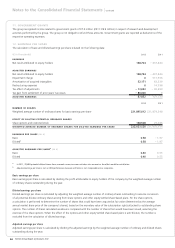

The contractual maturity of the principal and interest of our borrowings as of 31 December 2012 is presented below:

(€ in thousands) < 1 year 1-3 years > 3 years

Loan principal 75,000 75,000 100,000

Interest12,900 3,190 290

TOTAL 77,900 78,190 100,290

1 Interest on our variable rate borrowing is estimated assuming that the market interest and the required performance indicators remain constant based on the situation as

at 31 December 2012.