Tesco 2004 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2004 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46 TESCO PLC

NOTES TO THE FINANCIAL STATEMENTS CONTINUED

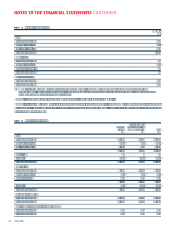

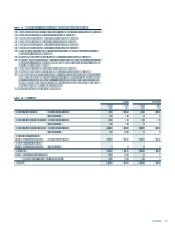

NOTE 25 Reserves

Group Company

2004 2003 2004 2003

£m £m £m £m

Share premium account

At start of period 2,465 2,004 2,465 2,004

Premium on issue of shares less costs 851 422 851 422

Scrip dividend election 154 39 154 39

At end of period 3,470 2,465 3,470 2,465

Other reserves

At 28 February 2004 and 22 February 2003 40 40

ProÞt and loss account

At start of period 3,649 3,136 430 255

(Loss)/gain on foreign currency net investments (157) 22 (2)

Issue of shares (25) (12)

Retained proÞt for the Þnancial year 584 503 255 175

At end of period 4,051 3,649 683 430

Other reserves comprise a merger reserve arising on the acquisition of Hillards plc in 1987.

In accordance with section 230 of the Companies Act 1985 a proÞt and loss account for Tesco PLC, whose result for the year

is shown above, has not been presented in these Þnancial statements.

The cumulative goodwill written-off against the reserves of the Group as at 28 February 2004 amounted to £718m (2003

£718m). During the year, the qualifying employee share ownership trust (QUEST) subscribed for 30 million, 0.4% of called-up

share capital at 28 February 2004 (2003 41 million, 0.6%), shares from the company. The amount of £25m (2003 £12m)

shown above represents contributions to the QUEST from subsidiary undertakings.

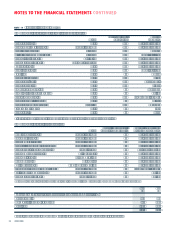

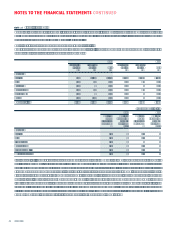

NOTE 26 Share options

Company schemes

The company had six principal share option schemes in operation during the year:

(i) The savings-related share option scheme (1981) permits the grant to employees of options in respect of ordinary shares

linked to a building society/bank save-as-you-earn contract for a term of three or Þve years with contributions from employees

of an amount between £5 and £250 per four-weekly period. Options are capable of being exercised at the end of the three

and Þve-year period at a subscription price not less than 80% of the middle-market quotation of an ordinary share immediately

prior to the date of grant.

(ii) The Irish savings-related share option scheme (2000) permits the grant to Irish employees of options in respect of ordinary

shares linked to a building society/bank save-as-you-earn contract for a term of three or Þve years with contributions from

employees of an amount between €12 and €320 per four-weekly period. Options are capable of being exercised at the end

of the three and Þve-year period at a subscription price not less than 75% of the middle-market quotation of an ordinary

share immediately prior to the date of grant.

(iii) The executive share option scheme (1984) permitted the grant of options in respect of ordinary shares to selected executives.

The scheme expired after ten years on 9 November 1994. Options were generally exercisable between three and ten years

from the date of grant at a subscription price determined by the Board but not less than the middle-market quotation within

the period of 30 days prior to the date of grant. Some options have been granted at a discount of 15% of the standard

option price but the option holder may take advantage of that discount only if, in accordance with investor protection ABI

guidelines, certain targets related to earnings per share are achieved.