Tesco 2004 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2004 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42 TESCO PLC

NOTES TO THE FINANCIAL STATEMENTS CONTINUED

NOTE 21 Financial instruments

An explanation of the objectives and policies for holding and issuing Þnancial instruments is set out in the Operating and Financial

Review on pages 2 to 5. Other than where these items have been included in the currency risk disclosures, short-term debtors

and creditors have been excluded from the following analysis.

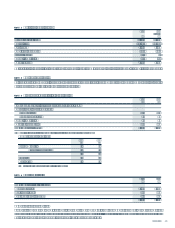

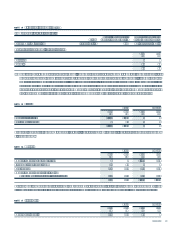

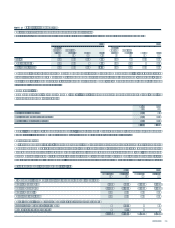

Analysis of interest rate exposure and currency of Þnancial liabilities

The interest rate exposure and currency proÞle of the Þnancial liabilities of the Group at 28 February 2004, after taking into

account the effect of interest rate and currency swaps, were:

2004 2003

Floating rate Fixed rate Floating rate Fixed rate

liabilities liabilities Total liabilities liabilities Total

£m £m £m £m £m £m

Currency

Sterling 360 2,702 3,062 1,145 2,476 3,621

Euro 508 23 531 361 23 384

Thai Baht 561 561 447 447

Czech Krona 317 77 394 227 80 307

Korean Won 272 272 404 404

Other 265 105 370 205 7 212

Gross Liabilities 2,283 2,907 5,190 2,789 2,586 5,375

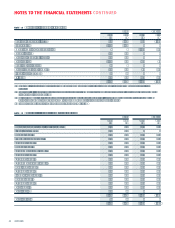

Fixed rate Þnancial liabilities

2004 2003

Weighted Weighted Weighted Weighted

average average time average average time

interest rate for which interest rate for which

28 Feb 2004 rate is Þxed 22 Feb 2003 rate is Þxed

% Years % Years

Currency

Sterling 5.3 6 5.8 7

Euro 5.4 1 5.4 3

Japanese Yen 1.05

Czech Krona 4.0 4 3.7 5

Taiwanese Dollar 4.5 2 4.5 2

Weighted average 5.3 6 5.8 7

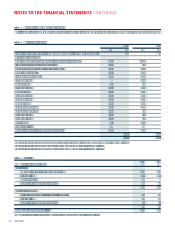

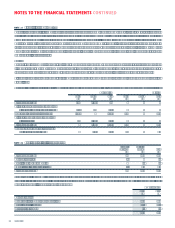

Floating rate liabilities bear interest at rates based on relevant national LIBOR equivalents. During the year, proÞtable swaps-to-

ßoating rate were monetised for a consideration of £235m and replaced with swaps-to-ßoating at market value. The interest rate

proÞle of the Group has been further managed by the purchase of Euro interest rate collars with an aggregate notional principal

of £135m (2003 £135m). The average strike price of the interest rate caps purchased is 6.76%, while the average strike price

of the interest rate ßoors sold is 2.98%. The average maturity of the collars is three and a half years. The current value of these

contracts, if realised, is a loss of £2.6m (2003 £2.3m). Retail Price Index funding of £220m (2003 £212m), maturing 2016,

is outstanding and has been classiÞed as Þxed rate debt. The interest rate payable on this debt is 4% and the principal is linked

to the Retail Price Index. Limited Price Index funding, of £221m (2003 £215m), maturing 2025, is outstanding and has been

classiÞed as Þxed rate debt. The interest rate payable on this debt is 3.322% and the principal is linked to the Retail Price Index.

The maximum indexation of the principal in any one year is 5.0% and the minimum is 0.0%.