Tesco 2004 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2004 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TESCO PLC 29

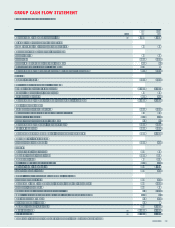

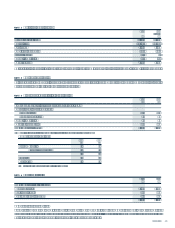

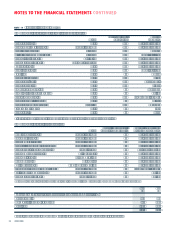

GROUP CASH FLOW STATEMENT

53 weeks ended 28 February 2004

2004 2003

note £m £m

Net cash inßow from operating activities 32 2,942 2,375

Dividends from joint ventures and associates

Income received from joint ventures and associates 60 11

Returns on investments and servicing of Þnance

Interest received 41 37

Interest paid (320) (253)

Interest element of Þnance lease rental payments (17) (2)

Cash received on sale of Þnancial instruments 235

Net cash outßow from returns on investments and servicing of Þnance (61) (218)

Taxation

Corporation tax paid (326) (366)

Capital expenditure and Þnancial investment

Payments to acquire tangible Þxed assets (2,239) (2,032)

Receipts from sale of tangible Þxed assets 62 32

Purchase of own shares (51) (52)

Net cash outßow from capital expenditure and Þnancial investment (2,228) (2,052)

Acquisitions and disposals

Purchase of subsidiary undertakings (269) (419)

Net cash at bank and in hand acquired with subsidiaries 53 33

Invested in joint ventures (48) (43)

Invested in associates and other investments (8) (7)

Net cash outßow from acquisitions and disposals (272) (436)

Equity dividends paid (303) (368)

Cash outßow before management of liquid resources and Þnancing (188) (1,054)

Management of liquid resources

Increase in short-term deposits (220) (14)

Financing

Ordinary shares issued for cash 868 73

(Decrease)/increase in other loans (180) 774

New Þnance leases 75 249

Capital element of Þnance leases repaid (73) (73)

Net cash inßow from Þnancing 690 1,023

Increase/(decrease) in cash 282 (45)

Reconciliation of net cash ßow to movement in net debt

Increase/(decrease) in cash 282 (45)

Cash outßow/(inßow) from decrease/(increase) in debt and lease Þnancing 178 (950)

Increase in liquid resources 220 14

Loans and Þnance leases acquired with subsidiaries (5) (172)

Amortisation of 4% unsecured deep discount loan stock, RPI and LPI bonds (20) (8)

Other non-cash movements (2) (19)

Foreign exchange differences (6) 3

Decrease/(increase) in net debt 647 (1,177)

Opening net debt 33 (4,737) (3,560)

Closing net debt 33 (4,090) (4,737)

Accounting policies and notes forming part of these Þnancial statements are on pages 30 to 55.