Tesco 2004 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2004 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TESCO PLC 15

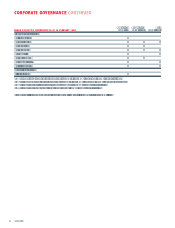

2An assessment of total shareholder return is the basis for

15% of the award. The total shareholder return (share price

growth and dividend performance) of the company at the

end of the year, taking into account performance over the

previous three and Þve years, is compared to the total

shareholder return of a selected peer group of UK and

International companies, comprising Ahold, Carrefour, Metro,

Safeway plc (UK), Safeway Inc. (US), J Sainsbury and Target

(US). Total shareholder return has been chosen as it is a

clear indicator of the value created for shareholders. The

Committee considers a comparator group comprising large

international food retailers as the most appropriate basis

for assessing relative performance.

3An assessment of the progress towards the achievement

of speciÞc strategic corporate goals is the basis for 8% of

the award.

Shares awarded have to be held for a period of four years,

conditional upon continuous service with the company.The share

equivalent of dividends, which would have been paid on the

shares, is added to the award during the deferral period.

Short-term share bonuses are awarded annually to each of the

Executive Directors, the maximum short-term bonus payable is

equivalent to 75% of salary. The bonus is based on a combination

of the following performance conditions:

1The achievement of targets set each year for growth in

EPS over the relevant Þnancial year is the basis for 77%

of the award.

2An assessment of achievement against speciÞc strategic

corporate goals is the basis for 23% of the award.

The bonus can be augmented by 50% if the participants elect

for the trustees of the scheme to retain the shares awarded

for a minimum period of two years, conditional upon continuous

service with the company. The share equivalent of dividends,

which would have been paid on the shares, is added to the

award during the deferral period.

The Executive Directors may choose to further extend the

holding period for both the short and long-term shares by a

further three years in each case. During this holding period, the

shares held are increased by 12.5% at the beginning of each

year, based on the scheme shares held and are conditional upon

continuous employment with the company. This holding period

may be extended subject to personal shareholding targets set

by the Committee, equivalent to shares to the value of one

times salary, being met by the Executive Directors.

In respect of the current year, the awards were long-term 75%

and short-term 75% of salary for each Executive Director.

Mr D E Reid was awarded £430,000, as part of a special bonus

in respect of the development of the Groups international

business. This amount has been sacriÞced in return for pension

augmentation. Mr J Gildersleeve and Mr R S Ager were awarded

bonuses of £150,000 each, which have been sacriÞced for pension

augmentation.

In addition to providing the opportunity to earn greater rewards

for superior performance, the Executive Incentive Scheme further

aligns the interests of shareholders and Executive Directors by

helping them to build up a shareholding in Tesco.

As outlined in the Directors Remuneration Policy section on

page 13, the executive incentive arrangements will be re-

structured during the Þnancial year ending February 2005 to

increase the link between rewards received and Tescos longer-

term Þnancial goals.

Annual performance will remain a key driver of the rebalanced

arrangements, with the annual bonus structure being retained.

The bonus will be delivered part in cash (which cannot be

deferred) and part in Tesco shares, receipt of which will be

deferred and conditional upon continuous employment with the

company. The deferral period will now be compulsory and will

be extended from two to three years.

The maximum awards that can be made will be 100% of salary

under the cash bonus and 75% of salary under the deferred

shares element. The deferred share award will no longer be

increased by any matching awards during the deferral period.

The bonus will continue to be subject to stretching performance

targets based on earnings per share growth and strategic

objectives and in the case of the deferred share element, a

measure of TSR as well, on a similar basis as the existing

incentives.

Participants will also be eligible to receive an award under

the proposed Performance Share Plan (PSP), the level of which will

be determined in relation to the achievement of ROCE objectives.

This plan will replace the existing long-term incentive arrangements.

Awards will be made over shares equal to 75% of salary. Awards

will vest on a sliding scale according to the achievement of the

ROCE targets measured over three years. The deferred shares

must then be retained for a further 12 months.

The proposed vesting schedule for PSP awards has been based

on the companys targets for the next Þve years regarding the

efÞcient use of capital. Awards will vest on a straight-line basis;