Tesco 2004 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2004 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TESCO PLC 35

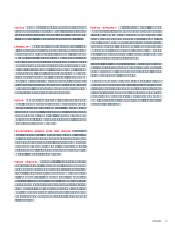

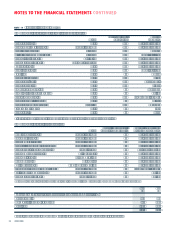

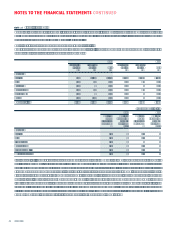

NOTE 9 Taxation continued

(b) Factors affecting the tax charge for the year

The effective rate of corporation tax for the year of 26.8% (2003 25.9%) is lower than the standard rate of corporation

tax in the UK of 30.0%. The differences are explained below:

2004 2003

%%

Standard rate of corporation tax 30.0 30.0

Effects of:

Expenses not deductible for tax purposes (primarily goodwill amortisation and non-qualifying depreciation) 4.1 3.9

Capital allowances for the year in excess of depreciation on qualifying assets (3.9) (3.3)

Differences in overseas taxation rates (0.9) (0.8)

Timing of tax relief of share-based payments 1.4

Prior year items (4.0) (4.4)

Other items 0.1 0.5

Effective rate of corporation tax for the year 26.8 25.9

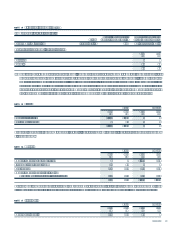

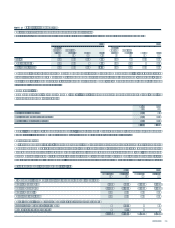

(c) Factors that may affect future tax charges

The Group has not recognised deferred tax assets of £12m (2003 £16m) in respect of certain tax losses which are available

to carry forward and offset, should future taxable proÞts arise.

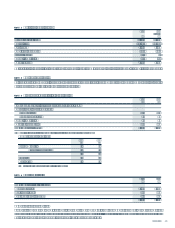

NOTE 10 Dividends

2004 2003 2004 2003

Pence/share Pence/share £m £m

Declared interim 2.07 1.87 151 131

Proposed Þnal 4.77 4.33 365 312

6.84 6.20 516 443

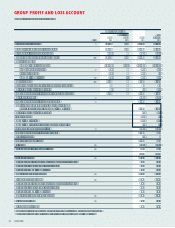

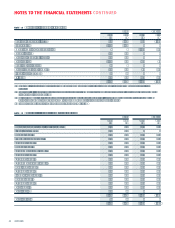

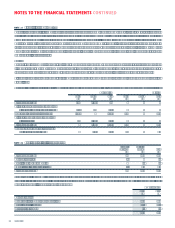

NOTE 11 Earnings per share and diluted earnings per share

Earnings per share and diluted earnings per share have been calculated in accordance with FRS 14, Earnings per Share. The

standard requires that earnings should be based on the net proÞt attributable to ordinary shareholders. The calculation for earnings,

including and excluding net loss on disposal of Þxed assets, integration costs and goodwill amortisation, is based on

the proÞt for the Þnancial year of £1,100m (2003 £946m).

For the purposes of calculating earnings per share, the number of shares is the weighted average number of ordinary shares

in issue during the year of 7,307 million (2003 6,989 million).

The calculation for diluted earnings per share uses the weighted average number of ordinary shares in issue adjusted by the

effects of all dilutive potential ordinary shares. The dilution effect is calculated on the full exercise of all ordinary share options

granted by the Group, including performance-based options which the Group considers to have been earned. The calculation

compares the difference between the exercise price of exercisable ordinary share options, weighted for the period over which

they were outstanding, with the average daily mid-market closing price over the period.

The alternative measure of earnings per share is provided because it reßects the Groups underlying trading performance excluding

the effect of the loss on disposal of Þxed assets, integration costs and amortisation of goodwill.

2004 2003

million million

Weighted average number of dilutive share options 61 62

Weighted average number of shares in issue in the period 7,307 6,989

Total number of shares for calculating diluted earnings per share 7,368 7,051