Tesco 2004 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2004 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18 TESCO PLC

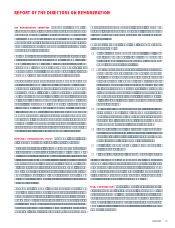

REPORT OF THE DIRECTORS ON REMUNERATION CONTINUED

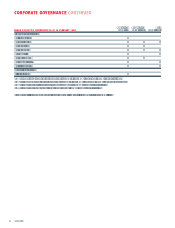

TABLE 2 Gains made on share options

Number of shares at exercise price (pence) Value realisable

Price at

exercise 2004 2003

70.0 98.3 151.7 176.7 178.0 205.0 Total (pence) £000 £000

Sir Terry Leahy 523,728 523,728 214.75 610 2,422

Mr D E Reid 11,427 223,728 601,305 836,460 241.30 879

Mr R S Ager

Mr P A Clarke

Mr J Gildersleeve 122,034 122,034 214.75 142

Mr A T Higginson

Mr T J R Mason* 198,669 18,000 15,000 9,888 241,557 244.00 209

Mr D T Potts

Date of grant 10.06.1997 3..07.1999 07.10.2000 21.05.2001 28.01.2002 26.06.2003

* Includes Mrs F M Mason

The value realisable from shares acquired on exercise is the difference between the fair market value at exercise and the exercise

price of the options, although the shares may have been retained. Where individual Directors exercised options on different dates,

the price at exercise shown represents an average of the prices on these dates weighted to the number of options exercised.

In the case of Mr D E Reid, all of the options at 70.0p were exercised at 59.7p as targets related to growth in earnings per

share in accordance with ABI guidelines, have been achieved. The share price at 28 February 2004 was 257.5p. The share price

during the 53 weeks to 28 February 2004 ranged from 159.0p to 262.0p.

The performance criteria for share options set out on page 16 is audited information.

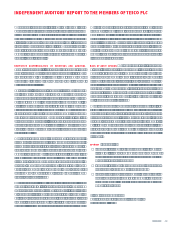

TABLE 3 Pension details of the Directors

Transfer Transfer

Increase Transfer value value

Total Increase in accrued value of total of total Increase

accrued in accrued pension of previous accrued accrued in transfer

Age at Years of pension at pension during the column at pension at pension at value less

28 February company 28 February during the year (net of 28 February 22 February 28 February Directors

2004 service 2004(a) year inßation) 2004 2003 2004 contributions

£000 £000 £000 £000 £000 £000 £000

Sir Terry Leahy (b) 48 25 433 50 39 471 2,554 3,801 1,247

Mr D E Reid (c) 57 19 409 38 27 1,531 5,273 8,010 2,737

Mr R S Ager (e) 58 18 287 30 23 390 3,910 4,844 934

Mr P A Clarke 43 29 200 31 26 191 941 1,447 506

Mr J Gildersleeve (e) 59 39 404 34 23 423 6,113 7,273 1,160

Mr A T Higginson (d) 46 6 112 25 22 181 545 908 363

Mr T J R Mason 46 22 223 26 20 163 1,204 1,802 598

Mr D T Potts 46 31 222 34 29 238 1,197 1,833 636

(a) The accrued pension is that which would be paid annually on retirement at 60, based on service to 28 February 2004.

(b) Sir Terry Leahy is entitled to retire at any age from 57 to 60 inclusive, with an immediate pension of two-thirds of base salary.

Part of his pension may be provided on an unfunded basis within a separate unapproved arrangement.

(c) Mr D E Reid retired early on 31 December 2003. The accrued total pension shown is his pension immediately after retirement.

In addition, Mr D E Reid sacriÞced £430,000 of a bonus payment in return for pension augmentation.

This pension augmentation has been taken into account for the accrued pension and transfer values at 28 February 2004.

(d) Part of Mr A T Higginsons beneÞts, in respect of pensionable earnings in excess of the earnings limit imposed by the Finance Act 1989,

are provided on an unfunded basis within a separate unapproved arrangement.

(e) As disclosed in Table 1, Mr R S Ager and Mr J Gildersleeve each sacriÞced £150,000 of bonus for pension augmentation.The actual

augmentations took place after 28 February 2004 and are therefore not included in the table above.

All transfer values have been calculated in accordance with Actuarial Guidance Note GN11.