Tesco 1998 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 1998 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Directors’ report

6

The directors present their annual re p o rt to shareholders on

the affairs of the Group together with the audited consolidated

financial statements of the Group for the 53 weeks ended

28 Fe b ru a ry 19 9 8 .

Principal activity and business rev i ew

The principal activity of the Group is the operation of food store s

and associated activities in the UK, No rthern Ireland, Republic of

Ireland, Czech Republic, Sl ovakia, Hu n g a ry and Poland. A re v i ew

of the business is contained in the Annual Re v i ew which is

published separately and, together with this document, comprises

the full Tesco P LC Annual Re p o rt and Ac c o u n t s .

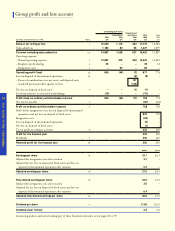

G roup re s u l t s

Group turnover excluding VAT rose by £2,565m to £16,452m,

re p resenting an increase of 18.5%. Group profit on ord i n a ry

activities before taxation, integration costs and loss on disposals

was £832m compared with £750m for the previous ye a r, an

i n c r ease of 10.9%. Including integration costs and loss on

disposals, Group profit on ord i n a ry activities before taxation

for the year was £728m. The amount allocated to the employe e

p rofit-sharing scheme this year was £35m as against £32m for

last ye a r. After provision for tax of £223m and dividends, paid

and proposed, of £255m, profit retained for the financial ye a r

amounted to £250m.

D i v i d e n d s

The directors recommend the payment of a final dividend

of 8.05p per ord i n a ry share to be paid on 1 July 1998 to

members on the Register at the close of business on 1 May 19 9 8 .

Together with the interim dividend of 3.55p per ord i n a ry share

p a i d in December 19 97, the total for the year comes to 11. 6 0 p

c o m p a r ed with 10.35p for the previous ye a r, an incre a s e

of 12 . 1 % .

Ta n g i ble fixed assets

Capital expenditure amounted to £841m compared with £731 m

during the previous ye a r. In the dire c t o r s’ opinion, the pro p e rt i e s

of the Group have a market value in excess of the book value of

£5,428m included in these financial statements.

A c q u i s i t i o n s

During the year the Group acquired, for a consideration of

£643m, retailing businesses in No rthern Ireland and the Re p u b l i c

of Ireland, a controlling interest in a Polish chain of stores for

£4m, and a number of businesses in the U K for £10m. Details of

acquisitions are set out in note 31 to the financial statements.

During the ye a r, the company invested £20m for 50% of the

s h a re s of a joint ve n t u re ,Tesco Personal Finance Group Limited,

with T h e Royal Bank of Scotland plc, £12m for 50% of the share s

in a joint ve n t u re, Tesco Personal Finance Life Limited, with

Scottish Wi d ows Fund and Life Assurance Society and £15 0 m f o r

50% of the shares in a joint ve n t u re , Tesco British Land Pro p e rt y

Pa rt n e r s h i p, with The British Land Company plc. Details of these

i n vestments are set out in note 12 to the financial statements.

S h a re cap i t a l

The authorised and issued share capital of the company, together

with details of the shares issued during the period, are shown in

note 22 to the financial statements. A bonus issue will be made

on 3 July 1998 in order to bring the issued share capital of the

company more into line with its operating assets. The bonus

issue will be on the basis of two new shares for eve ry one held

on that date.

C o m p a ny ’s share h o l d e r s

So far as the company is aware, at the date of this re p o rt

Prudential Corporation holds 75,646,845 ord i n a ry share s

(3.4% of the total)on behalf of itself and others. The company

is not aware of any other ord i n a ry shareholders with interests of

3% or more .

D i rectors and their intere s t s

The names and biographical details of the present directors are

set out in the separately published Annual Re v i ew.

Mr R S A g e r, Mrs LJames, Mr JW Melbourn and Mr G F

Pimlott re t i re from the Board by rotation according to the

c o m p a n y’s Articles of Association. Mr A T Higginson being

appointed during the year will also re t i re. Being eligible, they

offer themselves for re - e l e c t i o n .