Tesco 1998 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 1998 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

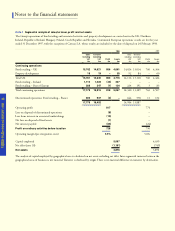

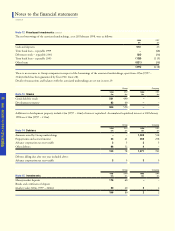

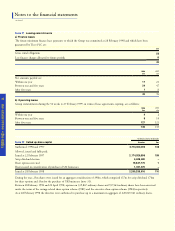

Note 20 Provisions for liabilities and charges

At 22 February 1997

Integration costs charged in the year

Amount utilised in year (a)

At 28 February 1998

Details of the integration costs are included in note 2.

a) Deferred taxation includes £3m disposed of as part of the sale of Catteau S.A. (see note 32).

3 1

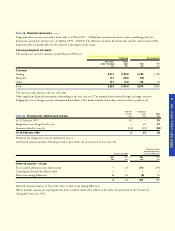

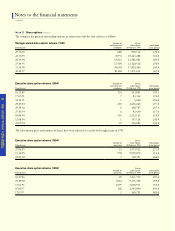

Currency

Sterling

Irish punt

Other

Total

The currency value shown is the year end value.

Other significant financial instruments outstanding at the year end are £77m nominal value forward foreign exchange contracts

hedging the cost of foreign currency denominated purchases. On a mark-to-market basis these contracts show a profit of nil.

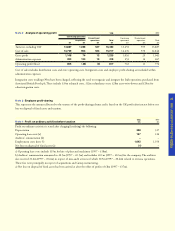

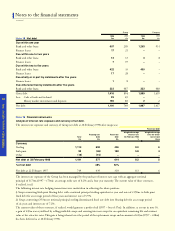

Currency analysis of net assets

The Group’s net assets by currency on 28 February 1998 were:

Net assets

before financing

£m

5,014

127

151

5,292

Gross

debt

£m

(1,219)

(182)

(15)

(1,416)

Financing

1998

£m

3,795

(55)

136

3,876

1997

£m

3,796

–

94

3,890

Net investment

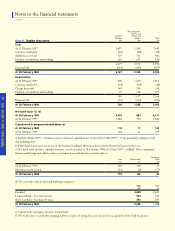

Note 19 Financial instruments c o n t i n u e d

Long-term debt over one year with a book value of £792m (1997 – £588m) has an estimated current value, considering only the

movements in risk-free interest rates, of £866m (1997 – £629m). The difference between the book value and the current value of this

long-term debt is partially offset by the deferred realised gain on the swaps.

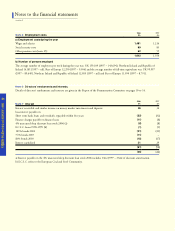

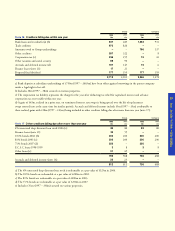

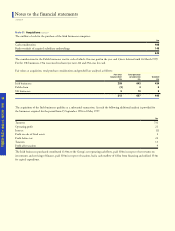

Deferred taxation – Group

Excess capital allowances over depreciation

Capital gains deferred by rollover relief

Short term timing differences

Deferred taxation balances in Tesco PLC relate to short term timing differences.

Where possible taxation on capital gains has been or will be deferred by rollover relief under the provisions of the Taxation of

Chargeable Gains Act 1992.

1998

£m

–

–

6

6

1997

£m

10

–

10

20

Amount provided

1998

£m

312

–

(8)

304

1997

£m

294

1

10

305

Potential amount

for deferred tax on

all timing differences

Total

£m

20

67

(49)

38

Deferred

taxation

£m

20

–

(14)

6

Integration

costs

£m

–

67

(35)

32