Tesco 1998 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 1998 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2 3

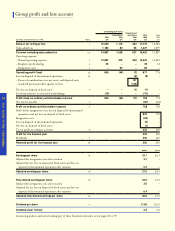

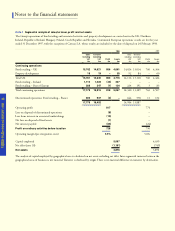

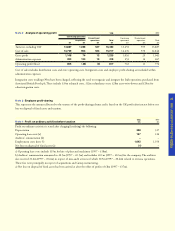

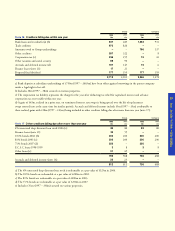

Note 3 Employee profit-sharing

This represents the amount allocated to the trustees of the profit-sharing scheme and is based on the UK profit after interest before net

loss on disposal of fixed assets and taxation.

Cost of sales includes distribution costs and store operating costs. Integration costs and employee profit-sharing are included within

administration expenses.

Integration costs totalling £95m have been charged, reflecting the need to reorganise and integrate the Irish operations purchased from

Associated British Foods plc.These include £35m relaunch costs, £12m redundancy costs, £28m asset write-downs and £20m for

other integration costs.

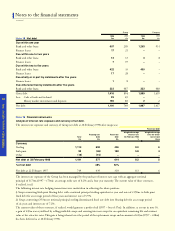

Note 2 Analysis of operating profit

Turnover excluding VAT

Cost of sales

Gross profit

Administration expenses

Operating profit/(loss)

Discontinued

operations

£m

595

570

25

14

11

Continuing

operations

£m

13,292

12,276

1,016

253

763

1998

Total

£m

16,452

15,217

1,235

418

817

Discontinued

operations

£m

537

524

13

15

(2)

Acquisitions

£m

1,028

954

74

120

(46)

£m

14,887

13,739

1,148

283

865

1997

Total

£m

13,887

12,846

1,041

267

774

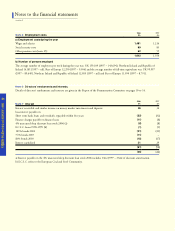

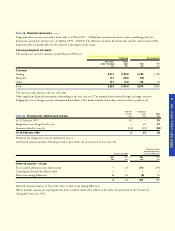

Note 4 Profit on ordinary activities before taxation

Profit on ordinary activities is stated after charging/(crediting) the following:

Depreciation

Operating lease costs (a)

Auditors’ remuneration (b)

Employment costs (note 5)

Net loss on disposal of fixed assets (c)

a) Operating lease costs include £19m for hire of plant and machinery (1997 – £18m).

b) Auditors’ remuneration amounted to £0.5m (1997 – £0.5m) and includes £0.1m (1997 – £0.1m) for the company. The auditors

also received £1.6m (1997 – £0.6m) in respect of non-audit services of which £0.5m (1997 – £0.4m) related to overseas operations.

These fees were principally in respect of acquisitions and Group restructuring.

c) Net loss on disposal of fixed assets has been arrived at after the offset of profits of £8m (1997 – £37m).

1998

£m

358

137

–

1,642

(1)

1997

£m

317

124

–

1,354

–

Continuing operations