Tesco 1998 Annual Report Download - page 32

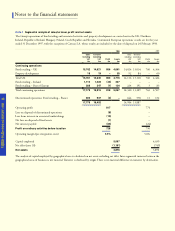

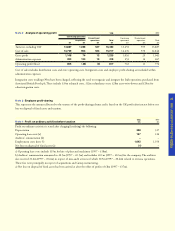

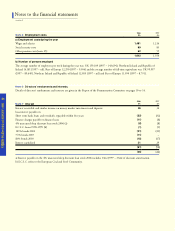

Download and view the complete annual report

Please find page 32 of the 1998 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

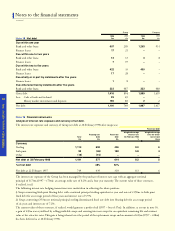

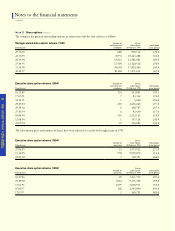

Weighted average

time for which

rate is fixed

Years

6

4

–

5

6

3 0

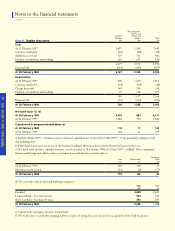

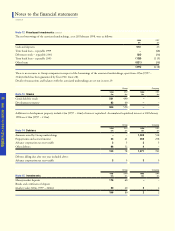

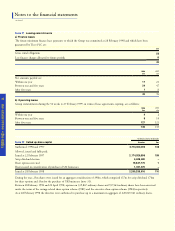

Note 18 Net debt

Due within one year

Bank and other loans

Finance leases

Due within one to two years

Bank and other loans

Finance leases

Due within two to five years

Bank and other loans

Finance leases

Due wholly or in part by instalments after five years

Finance leases

Due otherwise than by instalments after five years

Bank and other loans

Gross debt

Less: Cash at bank and in hand

Money market investments and deposits

Net debt

1998

£m

607

17

12

7

422

17

1

333

1,416

29

196

1,191

Group

1997

£m

285

21

13

19

33

28

8

487

894

65

80

749

1998

£m

1,263

–

3

–

400

–

–

333

1,999

–

2

1,997

Company

1997

£m

931

–

8

–

–

–

–

480

1,419

–

2

1,417

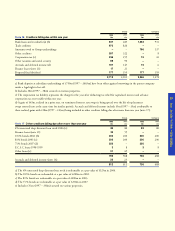

Currency

Sterling

Irish punt

Other

Net debt at 28 February 1998

% of net debt

Net debt at 22 February 1997

Fixed rate

debt

£m

456

158

–

614

52%

310

Floating rate

debt

£m

658

(66)

(15)

577

48%

439

Total

£m

1,114

92

(15)

1,191

749

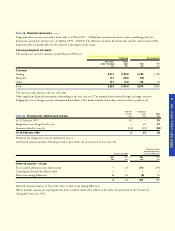

Note 19 Financial instruments

Analysis of interest rate exposure and currency of net debt.

The interest rate exposure and currency of Group net debt at 28 February 1998 after swaps was:

The interest rate exposure of the Group has been managed by the purchase of interest rate caps with an aggregate notional

principal of £170m (1997 – £70m), an average strike rate of 8.2% and a four year maturity. The current value of these contracts,

if realised, is nil.

The following interest rate hedging transactions were undertaken in achieving the above position:

i) Swaps converting Irish punt floating debt, with a notional principal sterling equivalent at year end rates of £158m, to Irish punt

fixed debt for an average period of four years and interest rate of 5.9%.

ii) Swaps converting £353m net notional principal sterling denominated fixed rate debt into floating debt for an average period

of six years and interest rate of 7.2%.

The current value of these contracts, if realised, would generate a profit of nil (1997 – loss of £7m). In addition, as set out in note 16,

a gain of £45m was crystallised by selling profitable swaps and entering into new swaps for an equivalent remaining life and contract

value at less attractive rates. This gain is being released over the period of the replacement swaps and an amount of £23m (1997 – £28m)

has been deferred as at 28 February 1998.

Notes to the financial statements

c o n t i n u e d

Weighted average

interest rate

28 February 1998

%

9.0

5.9

–

8.2

8.3

Fixed rate debt