Telus 2013 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2013 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

full committee’s review at the next scheduled quarterly meeting). Throughout the year,

the Audit Committee monitors the actual versus approved expenditure for each of the

approved requests.

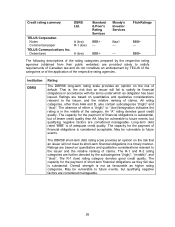

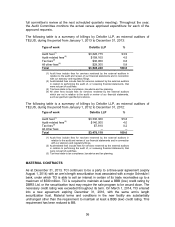

The following table is a summary of billings by Deloitte LLP, as external auditors of

TELUS, during the period from January 1, 2013 to December 31, 2013:

Type of work

Deloitte LLP

%

Audit fees(1)

$3,328,775

93.9

Audit-related fees(2)

$158,165

4.5

Tax fees(3)

$30,000

0.8

All other fees(4)

$28,300

0.8

Total

$3,545,240

100.0

(1) Audit fees include fees for services rendered by the external auditors in

relation to the audit and review of our financial statements and in connection

with our statutory and regulatory filings.

(2) Audit-related fees include fees for services rendered by the external auditors

in relation to performing the audit of, or reviewing financial statements, that

were not part of audit fees.

(3) Tax fees relate to tax compliance, tax advice and tax planning.

(4) All other fees include fees for services rendered by the external auditors

which are not in relation to the audit or review of our financial statements,

such as spectrum specified procedures.

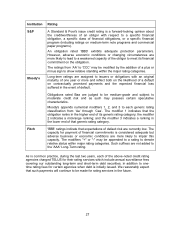

The following table is a summary of billings by Deloitte LLP, as external auditors of

TELUS, during the period from January 1, 2012 to December 31, 2012:

Type of work

Deloitte LLP

%

Audit fees(1)

$3,330,300

95.8

Audit-related fees(2)

$140,000

4.0

Tax fees(3)

$7,810

0.2

All other fees

--

--

Total

$3,478,110

100.0

(1) Audit fees include fees for services rendered by the external auditors in

relation to the audit and review of our financial statements and in connection

with our statutory and regulatory filings.

(2) Audit-related fees include fees for services rendered by the external auditors

in relation to performing the audit of, or reviewing financial statements, that

were not part of audit fees.

(3) Tax fees relate to tax compliance, tax advice and tax planning.

MATERIAL CONTRACTS

As at December 31, 2013, TCI continues to be a party to a three-year agreement (expiry

August 1, 2014) with an arm’s-length securitization trust associated with a major Schedule I

bank, under which TCI is able to sell an interest in certain of its trade receivables up to a

maximum of $500 million. TCI is required to maintain at least a BBB (low) credit rating by

DBRS Ltd. or the securitization trust may require the sale program to be wound down. The

necessary credit rating was exceeded throughout its term. On March 1, 2014, TCI entered

into a new agreement expiring December 31, 2016, with the same arm’s length

securitization trust. Material terms and conditions in the new facility are substantially

unchanged other than the requirement to maintain at least a BBB (low) credit rating. This

requirement has been reduced to BB.