Telus 2013 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2013 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26

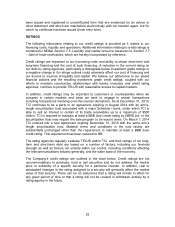

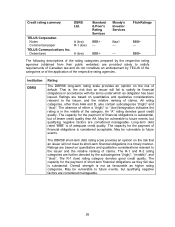

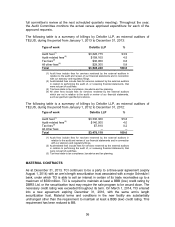

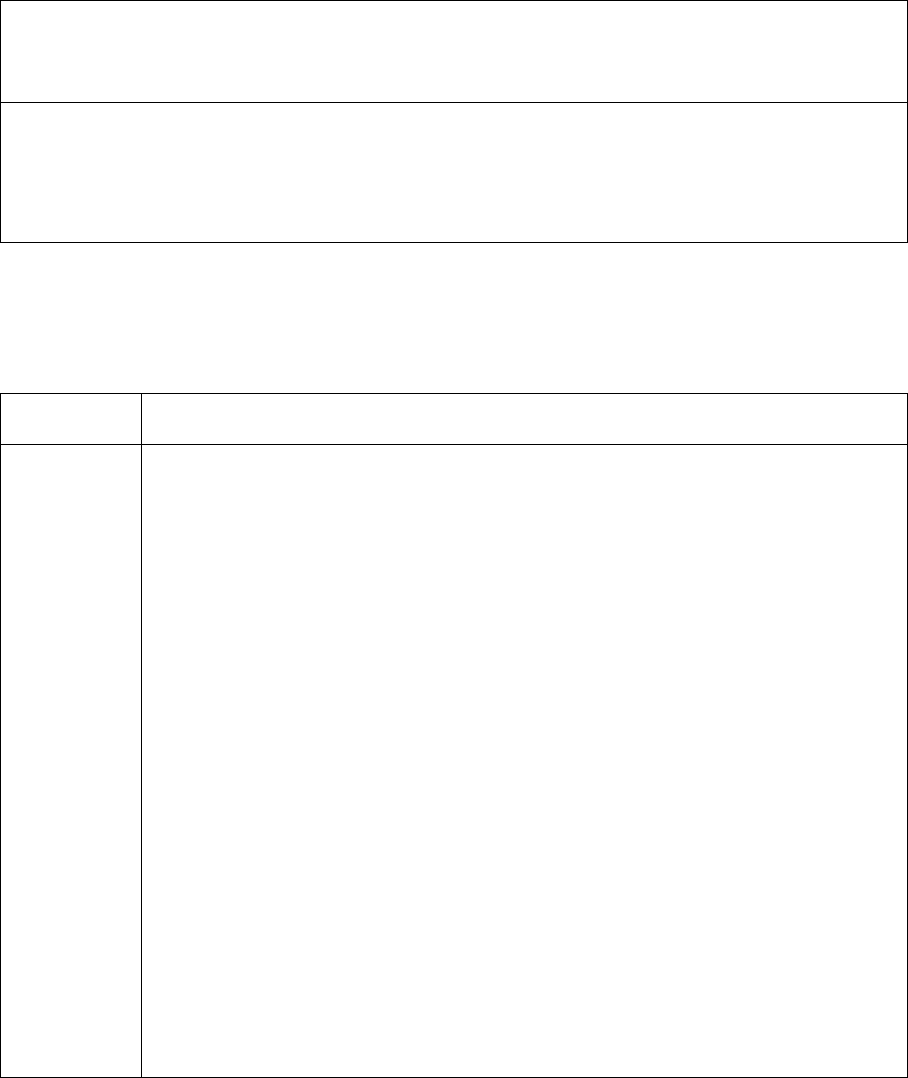

Credit rating summary

DBRS

Ltd.

Standard

& Poor’s

Rating

Services

Moody’s

Investor

Services

FitchRatings

TELUS Corporation

Notes

A (low)

BBB+

Baa1

BBB+

Commercial paper

R-1 (low)

—

—

—

TELUS Communications Inc.

Debentures

A (low)

BBB+

—

BBB+

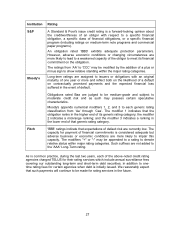

The following descriptions of the rating categories prepared by the respective rating

agencies (obtained from their public websites) are provided solely to satisfy

requirements of Canadian law and do not constitute an endorsement by TELUS of the

categories or of the application of the respective rating agencies.

Institution

Rating

DBRS

The DBRS® long-term rating scale provides an opinion on the risk of

default. That is, the risk that an issuer will fail to satisfy its financial

obligations in accordance with the terms under which an obligation has been

issued. Ratings are based on quantitative and qualitative considerations

relevant to the issuer, and the relative ranking of claims. All rating

categories, other than AAA and D, also contain subcategories “(high)” and

“(low)”. The absence of either a “(high)” or “(low)”designation indicates the

rating is in the middle of the category. An “A” rating denotes good credit

quality. The capacity for the payment of financial obligations is substantial,

but of lesser credit quality than AA. May be vulnerable to future events, but

qualifying negative factors are considered manageable. Long-term debt

rated “BBB” is of adequate credit quality. The capacity for the payment of

financial obligations is considered acceptable. May be vulnerable to future

events.

The DBRS® short-term debt rating scale provides an opinion on the risk that

an issuer will not meet its short-term financial obligations in a timely manner.

Ratings are based on quantitative and qualitative considerations relevant to

the issuer and the relative ranking of claims. The R-1 and R-2 rating

categories are further denoted by the subcategories “(high)”, “(middle)”, and

“(low)”. The R-1 (low) rating category denotes good credit quality. The

capacity for the payment of short-term financial obligations as they fall due

is substantial. Overall strength is not as favourable as higher rating

categories. May be vulnerable to future events, but qualifying negative

factors are considered manageable.