Telus 2013 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2013 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.25

been issued and registered in uncertificated form that are evidenced by an advice or

other statement and which are maintained electronically with our transfer agent, but for

which no certificate has been issued (book entry form).

RATINGS

The following information relating to our credit ratings is provided as it relates to our

financing costs, liquidity and operations. Additional information relating to credit ratings is

contained in MD&A Section 7.5- Liquidity and capital resource measures to Section 7.7

– Sale of trade receivables, which are hereby incorporated by reference.

Credit ratings are important to our borrowing costs and ability to obtain short-term and

long-term financing and the cost of such financing. A reduction in the current rating on

our debt by rating agencies, particularly a downgrade below investment grade ratings or

a negative change in its ratings outlook could adversely affect our cost of financing and

our access to sources of liquidity and capital. We believe our adherence to our stated

financial policies and the resulting investment grade credit ratings, coupled with our

efforts to maintain constructive relationships with banks, investors and credit rating

agencies, continue to provide TELUS with reasonable access to capital markets.

In addition, credit ratings may be important to customers or counterparties when we

compete in certain markets and when we seek to engage in certain transactions

including transactions involving over-the-counter derivatives. As at December 31, 2013,

TCI continues to be a party to an agreement expiring in August 2014 with an arm’s-

length securitization trust associated with a major Schedule I bank, under which TCI is

able to sell an interest in certain of its trade receivables up to a maximum of $500

million. TCI is required to maintain at least a BBB (low) credit rating by DBRS Ltd. or the

securitization trust may require the sale program to be wound down. On March 1, 2014

TCI entered into a new agreement expiring December 31, 2016 with the same arm’s

length securitization trust. Material terms and conditions in the new facility are

substantially unchanged other than the requirement to maintain at least a BBB (low)

credit rating. This requirement has been reduced to BB.

The rating agencies regularly evaluate TELUS and/or TCI, and their ratings of our long-

term and short-term debt are based on a number of factors, including our financial

strength as well as factors not entirely within our control, including conditions affecting

the telecommunications industry generally, and the wider state of the economy.

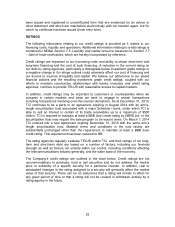

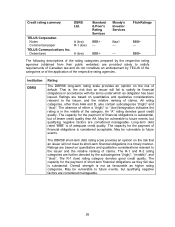

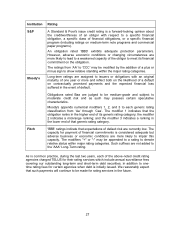

The Company’s credit ratings are outlined in the chart below. Credit ratings are not

recommendations to purchase, hold or sell securities and do not address the market

price or suitability of a specific security for a particular investor. In addition, real or

anticipated changes in the rating assigned to a security will generally affect the market

value of that security. There can be no assurance that a rating will remain in effect for

any given period of time or that a rating will not be revised or withdrawn entirely by a

rating agency in the future.