Shutterfly 2013 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2013 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

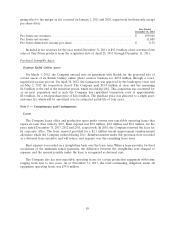

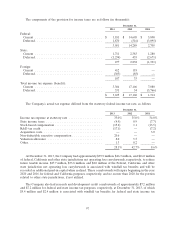

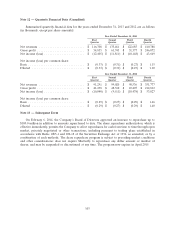

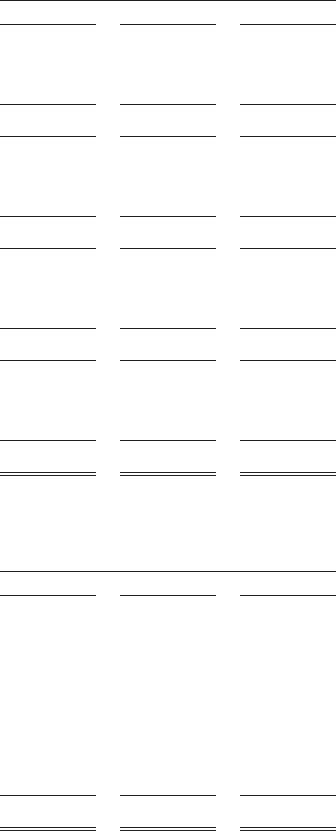

The components of the provision for income taxes are as follows (in thousands):

December 31,

2013 2012 2011

Federal:

Current ...................................... $ 1,181 $ 14,605 $ 5,800

Deferred ...................................... 1,870 (316) (3,095)

3,051 14,289 2,705

State:

Current ...................................... 1,711 2,383 1,280

Deferred ...................................... (1,234) 455 (2,671)

477 2,838 (1,391)

Foreign:

Current ...................................... 412 118 —

Deferred ...................................... (305) (85) —

107 33 —

Total income tax expense (benefit):

Current ...................................... 3,304 17,106 7,080

Deferred ...................................... 331 54 (5,766)

$ 3,635 $ 17,160 $ 1,314

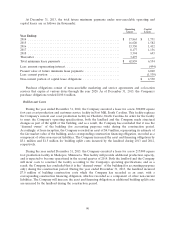

The Company’s actual tax expense differed from the statutory federal income tax rate, as follows:

December 31,

2013 2012 2011

Income tax expense at statutory rate ................... 35.0% 35.0% 34.0%

State income taxes ................................ (4.5) 0.9 (7.7)

Stock-based compensation ........................... (15.2) 1.1 (13.5)

R&D tax credit .................................. (17.1) — (7.2)

Acquisition costs .................................. — — 3.0

Non-deductible executive compensation ................. 20.6 — —

Valuation allowance ............................... 8.0 5.5 —

Other .......................................... 1.3 0.2 —

28.1% 42.7% 8.6%

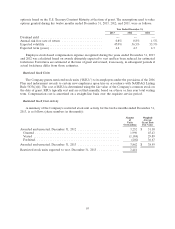

At December 31, 2013, the Company had approximately $39.9 million, $46.3 million, and $16.0 million

of federal, California and other state jurisdictions net operating loss carryforwards, respectively, to reduce

future taxable income. $27.7 million, $33.8 million, and $2.0 million of the Federal, California, and other

state jurisdiction net operating loss carryforwards is associated with windfall tax benefits and will be

recorded as additional paid-in capital when realized. These carryforwards will expire beginning in the year

2020 and 2016 for federal and California purposes, respectively, and no sooner than 2020 for the portion

related to other state jurisdictions, if not utilized.

The Company also had research and development credit carryforwards of approximately $7.2 million

and $7.2 million for federal and state income tax purposes, respectively, at December 31, 2013, of which

$5.4 million and $2.4 million is associated with windfall tax benefits for federal and state income tax

97