Shutterfly 2013 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2013 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

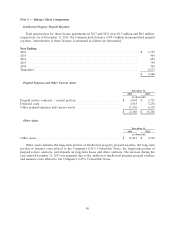

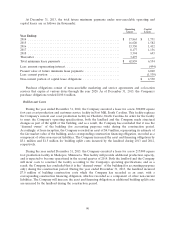

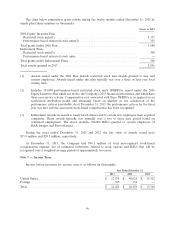

At December 31, 2013, the total future minimum payments under non-cancelable operating and

capital leases are as follows (in thousands):

Operating Capital

Leases Leases

Year Ending:

2014 .................................................... $ 17,863 $ 1,731

2015 .................................................... 16,620 1,582

2016 .................................................... 13,330 1,412

2017 .................................................... 8,177 1,136

2018 .................................................... 3,394 693

Thereafter ................................................ 3,475 —

Total minimum lease payments ................................. $ 62,859 6,554

Less: amount representing interest ............................... (494)

Present value of future minimum lease payments .................... 6,060

Less: current portion ........................................ (1,530)

Non-current portion of capital lease obligations ..................... $ 4,530

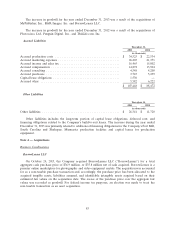

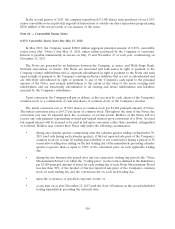

Purchase obligations consist of non-cancelable marketing and service agreements and co-location

services that expire at various dates through the year 2020. As of December 31, 2013, the Company’s

purchase obligations totaled $100.6 million.

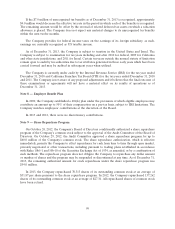

Build-to-suit Lease

During the year ended December 31, 2012, the Company executed a lease for a new 300,000 square

foot east coast production and customer service facility in Fort Mill, South Carolina. This facility replaces

the Company’s current east coast production facility in Charlotte, North Carolina. In order for the facility

to meet the Company’s operating specifications, both the landlord and the Company made structural

changes as part of the uplift of the building, and as a result, the Company has concluded that it was the

‘‘deemed owner’’ of the building (for accounting purposes only) during the construction period.

Accordingly, at lease inception, the Company recorded an asset of $4.9 million, representing its estimate of

the fair market value of the building, and a corresponding construction financing obligation, recorded as a

component of other non-current liabilities. The Company increased the asset and financing obligations by

$3.1 million and $1.5 million for building uplift costs incurred by the landlord during 2013 and 2012,

respectively.

During the year ended December 31, 2013, the Company executed a lease for a new 217,000 square

foot production facility in Shakopee, Minnesota. This facility will provide additional production capacity,

and is expected to become operational in the second quarter of 2014. Both the landlord and the Company

will incur costs to construct the facility according to the Company’s operating specifications, and as a

result, the Company has concluded that it is the ‘‘deemed owner’’ of the building (for accounting purposes

only) during the construction period. During the year ended December 31, 2013, the landlord incurred

$7.0 million of building construction costs which the Company has recorded as an asset, with a

corresponding construction financing obligation, which is recorded as a component of other non-current

liabilities. The Company will increase the asset and financing obligation as additional building uplift costs

are incurred by the landlord during the construction period.

90