Shutterfly 2013 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2013 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2012. The increase in general and administrative expense is primarily due to an increase in stock-based

compensation of $6.4 million as a result of increased headcount and an increase in depreciation and

amortization of $4.5 million. There was also an increase in personnel related costs of $3.9 million, an

increase in credit card fees of $3.3 million which was driven by the increase in Consumer net revenues as

compared to the prior year, an increase in facility costs of $1.5 million, and an increase in professional fees

of $1.5 million, offset by a reduction in the gains on disposition of assets of $0.9 million in 2013.

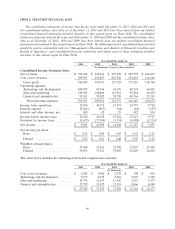

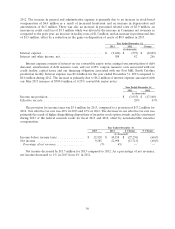

Year Ended December 31,

2013 2012 Change

(in thousands)

Interest expense .................................. $ (9,446) $ (597) $ (8,849)

Interest and other income, net ........................ 308 42 266

Interest expense consists of interest on our convertible senior notes arising from amortization of debt

discount, amortization of debt issuance costs, and our 0.25% coupon, issuance costs associated with our

credit facility; capital leases and our financing obligation associated with our Fort Mill, South Carolina

production facility. Interest expense was $9.4 million for the year ended December 31, 2013 compared to

$0.6 million during 2012. The increase is primarily due to $8.2 million of interest expense associated with

our May 2013 issuance of $300.0 million of 0.25% convertible senior notes.

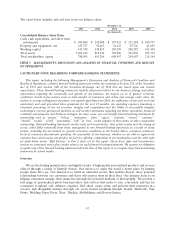

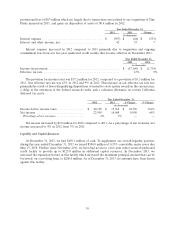

Year Ended December 31,

2013 2012

(in thousands)

Income tax provision ......................................... $ (3,635) $ (17,160)

Effective tax rate ........................................... 28% 43%

The provision for income taxes was $3.6 million for 2013, compared to a provision of $17.2 million for

2012. Our effective tax rate was 28% in 2013 and 43% in 2012. The decrease in our effective tax rate was

primarily the result of higher disqualifying dispositions of incentive stock option awards and the enactment

during 2013 of the federal research credit for fiscal 2013 and 2012, offset by non-deductible executive

compensation.

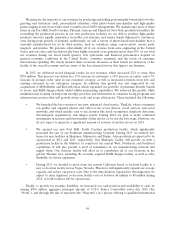

Year Ended December 31,

2013 2012 $ Change % Change

(in thousands)

Income before income taxes ............... $ 12,920 $ 40,158 $ (27,238) (68)%

Net income ........................... 9,285 22,998 (13,713) (60)%

Percentage of net revenues ................ 1% 4% ——

Net income decreased by $13.7 million for 2013 compared to 2012. As a percentage of net revenues,

net income decreased to 1% in 2013 from 4% in 2012.

56