Shutterfly 2013 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2013 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

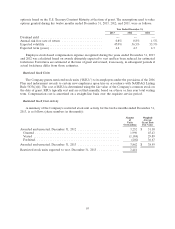

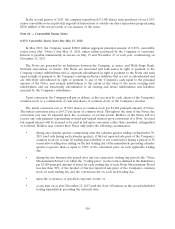

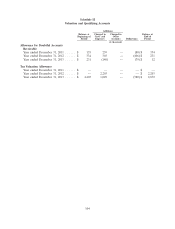

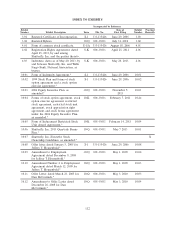

(carrying value excludes the equity component of the Company’s convertible notes classified in equity)

were as follows:

December 31, 2013 December 31, 2012

Fair Carrying Fair Carrying

Value Value Value Value

Convertible Senior Notes ................. $ 237,066 $ 243,493 — —

Note Hedge

To minimize the impact of potential economic dilution upon conversion of the Notes, the Company

entered into convertible note hedge transactions with respect to its common stock (the ‘‘Note Hedge’’). In

May 2013, the Company paid an aggregate amount of $63.5 million for the Note Hedge. The Note Hedge

will expire upon maturity of the Notes. The Note Hedge is intended to offset the potential dilution upon

conversion of the Notes and/or offset any cash payments the Company is required to make in excess of the

principal amount upon conversion of the Notes in the event that the market value per share of the

Company’s common stock, as measured under the Notes, is greater than the strike price of the Note

Hedge, which initially corresponds to the conversion price of the Notes and is subject to anti-dilution

adjustments substantially similar to those applicable to the conversion rate of the Notes.

Warrant

Separately, in May 2013, the Company entered into warrant transactions (the ‘‘Warrant’’), whereby the

Company sold warrants to acquire shares of the Company’s common stock at a strike price of $83.18 per

share. The Company received aggregate proceeds of $43.6 million from the sale of the Warrant. If the

average market value per share of the Company’s common stock for the reporting period, as measured

under the Warrant, exceeds the strike price of the Warrant, the Warrant will have a dilutive effect on the

Company’s earnings per share. The Warrant is a separate transaction, entered into by the Company and is

not part of the Notes or the Note Hedge, and has been accounted for as part of additional paid-in capital.

Holders of the Notes and Note Hedge will not have any rights with respect to the Warrant.

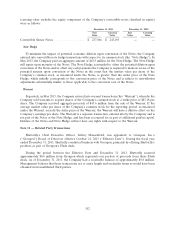

Note 11 — Related Party Transactions

Shutterfly’s Chief Executive Officer, Jeffrey Housenbold, was appointed to Groupon, Inc.’s

(‘‘Groupon’’) Board of Directors effective October 21, 2013 (‘‘Effective Date’’). During the fiscal year

ended December 31, 2013, Shutterfly conducted business with Groupon, primarily by offering Shutterfly’s

products as part of Groupon’s Flash deals.

During the period between the Effective Date and December 31, 2013, Shutterfly received

approximately $0.6 million from Groupon which represents our portion of proceeds from these Flash

deals. As of December 31, 2013, the Company had a receivable balance of approximately $0.8 million.

Management believes that these transactions are at arm’s length and on similar terms as would have been

obtained from unaffiliated third parties.

102