Shutterfly 2013 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2013 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Also during the year ended December 31, 2013 the Company executed a lease for a new 217,000

square foot production facility in Tempe, Arizona. This facility will consolidate all of the Company’s

locations in the greater Phoenix area, including the recently acquired R&R Images facility, as well as offer

flexibility for future expansion, and is expected to become operational during 2015. Both the landlord and

the Company will incur costs to construct the facility according to the Company’s operating specifications,

and as a result, the Company has concluded that it is the ‘‘deemed owner’’ of the building (for accounting

purposes only) during the construction period. As of December 31, 2013, construction had not yet begun,

and no amounts have been recorded. The Company will record the asset and financing obligation as

building uplift costs are incurred by the landlord during the construction period which we expect will begin

in 2014.

Upon completion of construction of these facilities, the Company evaluates the de-recognition of the

asset and liability under the provisions of ASC 840.40 Leases — Sale-Leaseback Transactions. However, if

the Company does not comply with the provisions needed for sale-leaseback accounting, the lease will be

accounted for as a financing obligation and lease payments will be attributed to (1) a reduction of the

principal financing obligation; (2) imputed interest expense; and (3) land lease expense (which is

considered an operating lease and a component of cost of goods sold) representing an imputed cost to

lease the underlying land of the facility. In addition, the underlying building asset will be depreciated over

the building’s estimated useful life which is generally 30 years. And at the conclusion of the lease term, the

Company would de-recognize both the net book values of the asset and financing obligation.

Construction of the Fort Mill, South Carolina facility was completed in the second quarter of 2013,

and at that time the Company concluded that it had forms of continued economic involvement in the

facility. As a result, the Company did not comply with provisions for sale-leaseback accounting and the

building is being accounted for as a financing obligation.

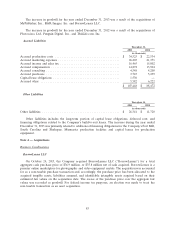

Indemnifications

In the normal course of business, the Company enters into contracts and agreements that contain a

variety of representations and warranties and provide for general indemnifications. The Company’s

exposure under these agreements is unknown because it involves future claims that may be made against

the Company, but have not yet been made. To date, the Company has not paid any claims or been required

to defend any action related to its indemnification obligations. However, the Company may record charges

in the future as a result of these indemnification obligations.

Contingencies

From time to time, the Company may have certain contingent liabilities that arise in the ordinary

course of its business activities. The Company accrues contingent liabilities when it is probable that future

expenditures will be made and such expenditures can be reasonably estimated.

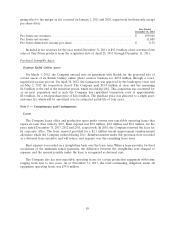

Syndicated Credit Facility

On November 22, 2011, the Company entered into a credit agreement (‘‘Credit Agreement’’) with J.P.

Morgan Securities LLC, Wells Fargo Securities, LLC, Fifth Third Bank, Silicon Valley Bank, US Bank and

Citibank, N.A. (‘‘the Banks’’). JPMorgan Chase Bank, N.A. acted as administrative agent in the Credit

Agreement. The Credit Agreement is for 5 years and provides for a $125.0 million senior secured revolving

credit facility (the ‘‘credit facility’’) and if requested by the Company, the Banks may increase the credit

facility by $75.0 million subject to certain conditions. In December 2013, the Company requested and

received the entire incremental amount for a total credit facility of $200.0 million. As part of the

expansion, Bank of America, N.A. and Morgan Stanley Bank, N.A. joined the syndicate. From inception

through December 31, 2013, the Company has not drawn on the credit facility.

91